Search

- A video I took of a Bend-Tech "Dragon" plasma cutter, it's a very cool machine! So much better than making paper patterns for the fabricators to fit up parts with. #STEM #engineering #CAD

- USD/CAD eyes 1.3800 📊 Fed decision, CAD jobs data in focus. #USDCAD #Forex #Fed #CAD htshorturl.at/yEMA2...

USD/CAD Forecast: Loonie Lifts Amid Oil Gain, Trade Deal Hope

The USD/CAD forecast points to strength in the oil markets, which is boosting the loonie. China and the US will hold trade talks on Saturday. The Fed will likely keep rates on hold. The USD/CAD forecast points to strength in the oil markets due to hopes of a trade deal between China and the US.... The post USD/CAD Forecast: Loonie Lifts Amid Oil Gain, Trade Deal Hope appeared first on Forex Crunch.dlvr.it- Bitcoin-backed loans ‘obvious’ next step — Xapo Bank CEO #forex #gold #XRP #bitcoin #trader #finance #CAD #aud

Bitcoin-backed loans ‘obvious’ next step — Xapo Bank CEO

Bitcoin holders are becoming more comfortable borrowing against their crypto as market confidence grows, according to Seamus Rocca, CEO of the Gibraltar-based private bank, Xapo Bank. In an interview at the Token2049 event in Dubai, Rocca told Cointelegraph that with Bitcoin (BTC) hovering around $95,000 and institutional adoption starting to catch on, the mood among investors has shifted from short-term speculation to a more long-term outlook. “I’m not sure that confidence would have been there three or four years ago,” Rocca told Cointelegraph. “But today, people are more comfortable to borrow against Bitcoin because we’re nowhere near the levels that would trigger liquidation.” On March 18, Xapo Bank launched a lending product that allows users to borrow US dollars using their Bitcoin as collateral. With the product, qualified clients can access up to $1 million in loans while keeping their BTC.Xapo Bank CEO Seamus Rocca at the Token2049 media lounge. Source: Cointelegraph Bitcoin-backed loans are an “obvious” next step Rocca told Cointelegraph that growing confidence in crypto’s long-term trajectory had fueled demand for the product. This has been driven by developments leading to broader institutional adoption. “Expectations are for institutional space coming in, the ETFs, and the mood music on Bitcoin is much more about wider adoption and long-term thinking than very short-term speculation,” Rocca said. He said this shift is the key to unlocking demand for borrowing against BTC, as investors feel more secure and feel that sharp price drops are less likely to happen. The Xapo Bank CEO said that its Bitcoin-backed loans offer loan-to-value (LTV) ratios of 20%, 30% and 40%, giving borrowers flexibility while managing risk. “If you get a 20% LTV loan and you have 100 Bitcoin, as a lot of early adopters do, that’s still a couple of million dollars you can borrow without having to sell them,” Rocca said. With conservative LTV levels like 20%, Bitcoin must fall below $40,000 for borrowers to get liquidated. “We’re nowhere near $40,000,” Rocca told Cointelegraph, pointing to the current price stability as a reason for growing borrower confidence. Related: Blockchains ready for institutions, lawyers hesitate: DoubleZero CEO Borrowing helps investors avoid selling in emergencies Rocca said Bitcoin-backed loans provide a solution for holders who want to stay exposed to BTC when facing life’s unexpected expenses. “If you follow the ethos of investing, the smart thing to do would be not to sell it in three days if it goes to $100,000,” Rocca said. “But life gets in the way,” Rocca added. He told Cointelegraph that unexpected costs, like medical bills or replacing a car, often force investors to liquidate assets at unfavorable times. Rocca said that instead of selling Bitcoin for a $10,000 expense, investors could borrow against their holdings while simply paying interest on the loan. “You continue to have the upside potential of the price appreciation of the Bitcoin because you haven’t sold it,” he said. “But you get liquidity to pay for things that you need in everyday life.” With institutional adoption deepening and the Bitcoin market maturing, the Xapo Bank executive is betting that more long-term holders will be ready to tap into crypto liquidity without selling their BTC. This marks a shift from the “hodl” culture to an age where Bitcoin owners can do more with the asset. Magazine: 12 minutes of nail-biting tension when Ethereum’s Pectra fork goes livedlvr.it - Plant-based diets are best for our health and for our only planet 🌱 Vegan Eating Would Slash Food's Global Warming Emissions: Study www.nbcnews.com/health/diet-... #PlantBased #WFPB #diet #ItsTheDiet #vegan #cholesterol #LDLc #CVD #CAD #HeartDisease #lifestyle #cardiology

8 Million Fewer Would Die if the World Went Vegan

If everyone went vegan, 8 million fewer people would die per year by 2050, and global warming could be slashed, a new study finds.nbcnews.com- New reports tell us cattle and sheep farming can be sustainable – don’t believe them, it’s all bull | George Monbiot #Science #EarthSciences #EnvironmentalScience #Sustainability #ClimateChange #Agriculture

New reports tell us cattle and sheep farming can be sustainable – don’t believe them, it’s all bull | George Monbiot

Feeding the world sustainably is an incredibly complex challenge, yet some people are trying to sell us a bucolic fairytale, says Guardian columnist George Monbiottheguardian.com

- Hacken CEO sees ‘no shift’ in crypto security as April hacks hit $357M #forex #gold #XRP #stocks #eurusd #investment #CAD #finance

Hacken CEO sees ‘no shift’ in crypto security as April hacks hit $357M

Despite the $1.4 billion lost in the recent Bybit hack, crypto companies have not changed their approach to cybersecurity, according to Hacken CEO Dyma Budorin. In an interview with Cointelegraph at the Token2049 event in Dubai, Budorin said the industry continues to rely on limited measures such as bug bounties and penetration tests, rather than implementing comprehensive, layered security strategies:“Most of the projects think, ‘Okay, we did pentests. That’s enough. Maybe bug bounty. That’s enough.’ It’s not enough.” He said that crypto companies must go beyond these isolated security measures and adopt more layered approaches similar to those of traditional industries. These include supply-chain security, operational security and blockchain-specific security assessments. “In big Web2 companies, this is mandatory,” Budorin added. Dyma Budorin at the Token2049 event in Dubai. Source: Cointelegraph Real-time blacklisting, a step forward While crypto security approaches remained the same, post-hack security approaches shifted slightly. Budorin told Cointelegraph there were some improvements in the crypto space’s post-hack security responses. “Maybe a little shift from a post-hack approach,” Budorin told Cointelegraph, pointing to how the security firm Chainalysis introduced near real-time blacklisting of stolen funds. The executive said this small improvement is a step toward progress in crypto security. “This is great because, previously, Chainalysis was blacklisting within three days when the funds were moving. And this is obviously nothing because hackers had enough time to launder, through exchanges, the stolen money,” Budorin said. On Feb. 21, the Bybit hack saw $1.4 billion in crypto stolen through a Safe wallet vulnerability. This became the largest crypto hack in history. After the hack, the malicious actors laundered 100% of the stolen money in just 10 days. While faster blacklisting is a good step forward, it still doesn’t address the deeper structural risks. “But in terms of the practice, cybersecurity, nothing changed,” Budorin told Cointelegraph. Related: Bybit hacker launders 100% of stolen $1.4B crypto in 10 days Crypto losses near $360 million in April In April 2025, blockchain security firm PeckShield reported that the space saw nearly $360 million in digital assets stolen across 18 hacking incidents. Source: PeckShield April’s losses show a 990% increase compared to March, when crypto lost to hacks totalled about $33 million. The largest chunk of the losses came from an unauthorized Bitcoin transfer. On April 28, blockchain investigator ZachXBT flagged a suspicious transfer of $330 million in BTC. The investigator later confirmed that the transfer was a social engineering attack targeting an elderly individual in the United States. Magazine: 12 minutes of nail-biting tension when Ethereum’s Pectra fork goes livedlvr.it - Bitcoin pushes for $98K as 2025 Fed rate cut odds flip 'pessimistic' #forex #gold #XRP #forexlifestyle #money #CAD #stocks #oil

Bitcoin pushes for $98K as 2025 Fed rate cut odds flip 'pessimistic'

Key points: * Bitcoin and gold trade in lockstep on low timeframes as macro volatility triggers heighten. * The Federal Reserve interest rate decision and press conference is just hours away. * Market sentiment for rate cuts in 2025 decreases sharply ahead of the FOMC meeting. Bitcoin (BTC) saw a flash short-term trend change into May 7 as geopolitical triggers gave risk assets fresh volatility.BTC/USD 1-hour chart. Source: Cointelegraph/TradingView Bitcoin traders eye Fed for “tone changes” Data from Cointelegraph Markets Pro and TradingView showed an abrupt turnaround for BTC/USD after the pair dipped under $94,000 to set new May lows. The previous day’s Wall Street trading session then set the stage for a return to strength, even as stocks finished lower.XAU/USD 4-hour chart. Source: Cointelegraph/TradingView Both Bitcoin and gold went on to reach local highs of $97,700 and $3,435, respectively, before consolidating. News of tensions boiling over between India and Pakistan, along with potential progress on a US-China trade deal, kept markets lively. This reaction to US-China trade talks being scheduled tells you all you need to know. A LOT is already priced-in here. pic.twitter.com/jT6pKOdgiQ— The Kobeissi Letter (@KobeissiLetter) May 7, 2025 Traders had no time to relax, meanwhile, with the Federal Reserve interest rate decision due later on May 7. While market expectations for the Federal Open Market Committee (FOMC) meeting were practically unanimous, as Cointelegraph reported, Fed Chair Jerome Powell’s subsequent statement and press conference were of more interest. “The market will be eager to watch for any dovish or hawkish changes in their tone which has been pretty mixed recently,” popular trader Daan Crypto Trades summarized in part of ongoing X analysis alongside data from CME Group’s FedWatch Tool.Fed target rate probabilities for May 7 FOMC meeting. Source: CME Group Examining Bitcoin order book activity, Keith Alan, co-founder of trading resource Material Indicators, said that nearby liquidity had been “cleared out” in advance of the event. “Pleasantly surprised BTC held above the YOU, but won’t be surprised if price round trips the range before the end of the week,” he told X followers, referring to the yearly open level at $93,500 as a potential downside target.BTC/USDT order book data. Source: Keith Alan/X ”Clearly pessimistic” Continuing, Darkfost, a contributor to onchain analytics platform CryptoQuant, noted declining odds of rate cuts coming sooner in 2025. Related: Bitcoin could rally regardless of what the Federal Reserve FOMC decides this week: Here’s why At the time of writing, the June FOMC meeting had combined rate cut odds of around 30% — noticeably lower than in recent weeks. “Expectations are clearly pessimistic for now,” he concluded. “If the Fed does decide to cut rates in this context, it will trigger volatility and might spark fear among investors (depending about how many Bps).”Fed target rate probability comparison for June 18 FOMC meeting. Source: CME Group This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.dlvr.it - Bitcoin price blitz $730M sell-wall amid India’s missile attack on Pakistan #XRP #forex #gold #finance #cryptocurrency #CAD #invest #crypto

Bitcoin price blitz $730M sell-wall amid India’s missile attack on Pakistan

Bitcoin price surged to $97,260 after initially retracing below $94,000 on Wednesday amid India’s missile attack on Pakistan, triggering market-wide volatility.dlvr.it Keen Maker (@keenmaker.bsky.social)

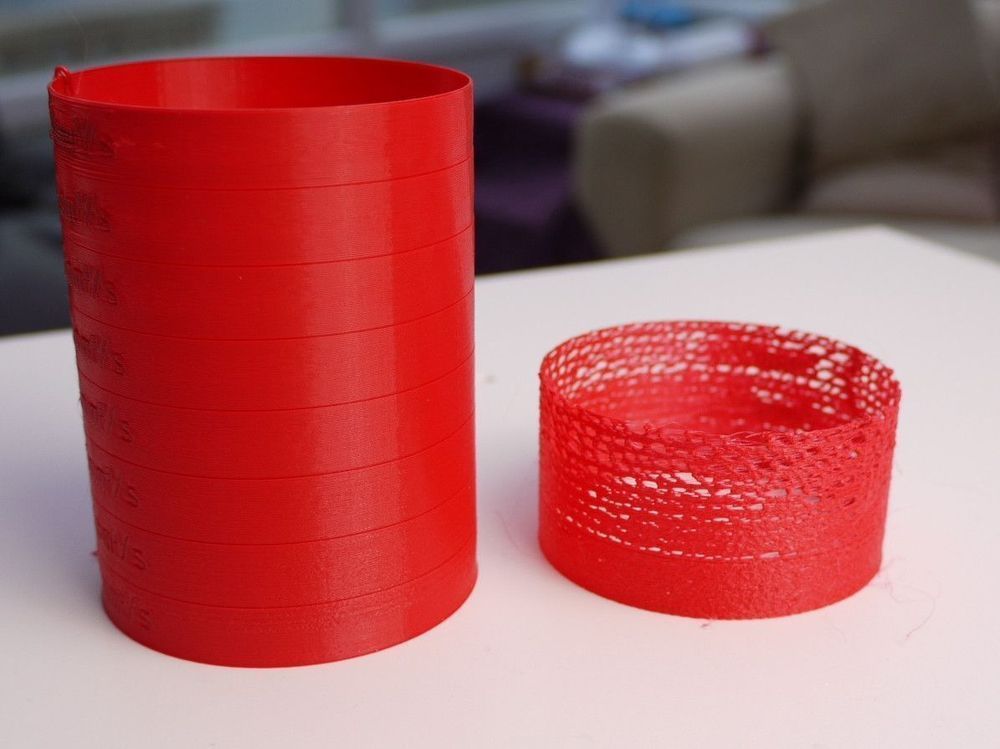

Under-extrusion fix checklist: • Check the nozzle for clogs. • Calibrate extruder steps/mm. • Test your filament for consistency. Fix this, and watch your quality improve. #3dprinting #3dprinter…bsky.app- Ethereum Price Forecast: Short sellers dominate ETH futures, but spot investors remain bullish ahead of Pectra upgrade #XRP #forex #gold #forexmarket #CAD #investment #finance #USD

Ethereum Price Forecast: Short sellers dominate ETH futures, but spot investors remain bullish ahead of Pectra upgrade

Ethereum (ETH) saw a 2% decline on Tuesday following an increase in short positions ahead of the Pectra upgrade set to go live within the next 24 hours.dlvr.it - Replying to jgil65

- Solana sees slight decline despite DeFi Development Corp's $11.2 million and SOL Strategies' $18.2 million SOL purchases #XRP #forex #gold #invest #Eur #aud #CAD #money

Solana sees slight decline despite DeFi Development Corp's $11.2 million and SOL Strategies' $18.2 million SOL purchases

Solana (SOL) dropped to $142 on Tuesday despite DeFi Development Corporation's latest purchase of 82,404 SOL, raising its total holdings above 400,000 SOL. Likewise, Toronto-based company SOL Strategies also acquired $18 million worth of SOL at an average price of $148.96 per token.dlvr.it - Bitcoin could rally regardless of what the Federal Reserve FOMC decides this week: Here’s why #forex #gold #XRP #aud #CAD #bitcoin #stocks #oil

Bitcoin could rally regardless of what the Federal Reserve FOMC decides this week: Here’s why

Key Takeaways: * The Fed may pause rates but inject liquidity. Crypto could rally as a recession hedge. * The weak US dollar and gold rally signal a shift to scarce assets. The US Federal Reserve Open Market Committee (FOMC) interest rate decision on May 7 will be a defining moment for risk-on assets, including cryptocurrencies. While the consensus points to no change in interest rates, Bitcoin (BTC) and altcoins could see gains if the US Treasury is compelled to inject liquidity to stave off an economic recession. A more accommodative monetary policy could stimulate activity, but the Federal Reserve (Fed) is also contending with a weakening US dollar. Some analysts argue that a US interest rate cut may fail to stimulate growth as recession risks persist, potentially creating an ideal environment for alternative hedge assets such as cryptocurrencies.Source: Jim Paulsen Economist and investor Jim Paulsen notes that when Fed funds trade above a “neutral” interest rate (Fed Funds minus the annual core Personal Consumption Expenditures Index), the economy has historically moved toward recession or a “growth recession,” a period of sluggish growth with rising unemployment and weak consumer demand. Similar patterns since 1971 support this analysis. According to Paulsen, the Fed will likely be compelled to lower interest rates. Moreover, central bank Chair Jerome Powell is under significant pressure from US President Donald Trump, who has criticized the Fed for not reducing the cost of capital quickly enough. Reasons why the Fed could start easing Concerns about overheated markets remain as the US consumer inflation exceeds the 2% target, and April unemployment rates of 4.2% suggest no signs of economic weakness.FOMC rates estimate for the Sept. 17 decision. Source: CME FedWatch Market expectations, as reflected in Treasury yield futures, show a 76% chance of interest rates at 4.0% or lower by Sept. 17. This probability has dropped considerably from 90% on April 29, according to the CME FedWatch tool. Traders are growing less confident that the Fed will ease monetary policy. While this may initially seem bearish for risk assets, it could prompt the Treasury to inject liquidity into markets to support government spending. Regardless of the FOMC’s decision, some analysts point out that the Fed’s recent $20.5 billion Treasury bond purchase on May 5 signals renewed intervention. Additional liquidity has historically been bullish for cryptocurrencies, especially as the US dollar lags behind other major global currencies. Consequently, investors are increasingly seeking alternative hedges rather than holding cash. Related: Bitcoin price rallied 1,550% the last time the ‘BTC risk-off’ metric fell this lowDXY US Dollar Index (left, green) vs. Bitcoin/USD (orange). Source: TradingView / Cointelegraph The US Dollar Index (DXY) has dropped below 100 for the first time since July 2023, as investors retreat from US markets amid economic uncertainty. Meanwhile, gold has risen over 12% in the past 30 days and is now trading just 2% below its all-time high of $3,500. Declining confidence in the US Treasury’s ability to finance its debt favors scarce assets such as Bitcoin. While the probability of multiple rate cuts has diminished, this scenario may still be favorable for cryptocurrencies. Should the Fed be pressured to expand its balance sheet, it would likely fuel inflation and erode the value of fixed-income investment factors that ultimately support cryptocurrencies. This article is for general information purposes and is not intended to be and should not be taken as legal or investment advice. The views, thoughts, and opinions expressed here are the author’s alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.dlvr.it The S&P and Nasdaq indice bounce near 50-hour MAs. Buyers still holding short-term control

Both the S&P 500 and Nasdaq indices came under modest selling pressure today, but buyers stepped in near key technical support, helping to stabilize the declines. S&P 500 Index * The index dipped to an intraday low of 5586.04, just above the 50-hour moving average at 5583.09 * The MA held as support, keeping the short-term bullish bias intact. * A break below this level would expose the 50% retracement of the March-April decline near 5491.24, and could invite further selling momentum. Nasdaq Composite Index * The Nasdaq also softened intraday, reaching a session low of 17,592. * However, the 50-hour moving average at 17,573 provided a technical floor, as buyers leaned against it. * A move below the MA would be more bearish and could lead to a deeper pullback, with the next support 50% midpoint of the move down from the mid-December high. Pamela comes in at 17494131 Despite today's pullback, the bounce off these key hourly moving averages shows that dip buyers remain active. The 50-hour MAs now serve as key short-term risk levels for both indices. A sustained break below would shift near-term momentum more clearly to the downside. This article was written by Greg Michalowski at www.forexlive.com.dlvr.it- Top 3 gainers Bittensor, Akash Network, Saros: AI tokens steady amid wider market consolidation #XRP #forex #gold #forextrader #trading #forexlifestyle #CAD #trader

Top 3 gainers Bittensor, Akash Network, Saros: AI tokens steady amid wider market consolidation

The broader cryptocurrency market is in a consolidation rut, with Bitcoin (BTC) holding above $94,000. However, select Artificial Intelligence (AI) tokens, including Bittensor, Akash Network and Saros, have remained steady in the last 24 hours.dlvr.it - Cardano Price Forecast: ADA builds bearish momentum amid on-chain weakness #XRP #forex #gold #CAD #forexsignals #money #business #trader

Cardano Price Forecast: ADA builds bearish momentum amid on-chain weakness

Cardano (ADA) price hovers around $0.650 at the time of writing on Tuesday after falling nearly 6% over the last two days. On-chain data supports the bearish thesis, as funding rates are negative and network activity is falling.dlvr.it - 🎧 Just designed & 3D printed a custom headphones holder from scratch in #SolidWorks 🎧 I wanted to create something functional, and I love how clean it came out. Printed on my #Creality K1. Check out the process video below! Would you use this design? #3DPrinting #CAD #gamer #headphones #music

- US Treasury sanctions Myanmar militia group for alleged crypto scams #forex #gold #XRP #USD #aud #money #CAD #trader

US Treasury sanctions Myanmar militia group for alleged crypto scams

The United States Department of the Treasury has sanctioned a Myanmar militia group known as the Karen National Army (KNA), accusing it of crypto-related scams and other criminal activities. According to a May 5 press release issued by the agency, the Karen National Army has been orchestrating a variety of crypto scams, including the infamous “pig butchering” scam, which lures victims into contributing more and more to fake crypto schemes. Americans “have collectively lost billions of dollars” from scams such as those emanating from Myanmar, the release reads, without specifying an amount. “Today, the U.S. Department of the Treasury’s Office of Foreign Assets Control (OFAC) sanctioned the Karen National Army (KNA), a militia group in Burma, as a transnational criminal organization, along with the group’s leader Saw Chit Thu, and his two sons, Saw Htoo Eh Moo and Saw Chit Chit, for their role in facilitating cyber scams that harm U.S. citizens, human trafficking, and cross-border smuggling,” the release reads. Many international bodies, including the US, continue to refer to “Burma,” the country’s former name, to demonstrate that they don’t recognize the military regimes that have been in power at various times since a 1989 coup in which the military changed the name to Myanmar. The KNA operates in southeastern Myanmar, along the Thailand border. The Treasury’s Office of Foreign Assets Control (OFAC) has issued numerous sanctions against crypto-offenders over the past few years, including Middle East-based terrorist groups, cybercrime units operating overseas, and privacy-focused crypto technology like Tornado Cash. Related: FBI warns of North Korean ’social engineering’ schemes to steal crypto Crypto scams target US residents According to the Federal Bureau of Investigation (FBI), Americans lost $9.3 billion to crypto scams in 2024, an increase of roughly 66% from 2023. The most affected group is formed by individuals over the age of 60, who reported a cumulative loss total of $2.8 billion. Pig butchering scams are known for their significant impact on victims, both in the crypto space and beyond. The scam consists of a long-term financial fraud where scammers build trust with victims over time, often through social media or messaging platforms, before convincing them to invest in fake or manipulated crypto schemes. According to TRM Labs, a blockchain intelligence company, these scams accounted for well over $4.4 billion stolen in 2023. According to the Treasury Department’s press release, this type of scam is currently common in Southeast Asia, primarily involving trafficked individuals defrauding victims. The Karen National Army is allegedly engaged in orchestrating both pig butchering scams and human trafficking networks that enable them to operate at scale. Magazine: Influencers shilling memecoin scams face severe legal consequencesdlvr.it - I am designing and building my own VHS tape cleaner for restoration. #cad #fusion360 #3dprinting #vhs