Michael Santoli

CNBC talking head. Markets, mostly. Maybe some baseball and movies.

- Song about the crazy life was released the same month the QQQ ETF was launched, the entire culture was on the same page. Exactly a year later, with the Nasdaq higher by 110%, the bubbliest of market bubbles peaked. Soon, history would resume...

- Assume they'll discuss how Rose's on-field output looks less impressive via today's statistical lens. Akin to Boggs and Gwynn (with 75% of their hits singles), but trails both badly in OPS/OPS+. Quite similar to Jeter, with less power. Tacked on 600 hits in his final years as a below-average player.

- Talking Pete Rose, Shoeless Joe, and the Hall of Fame with the great @dvnjr.bsky.social, @keithob.bsky.social, and @jayjaffe.bsky.social next week! Hope you'll join us on Zoom for this SABR webinar: sabr.org/latest/join-...

- Mariano Rivera continues to stand alone as the only unanimous selection on a first ballot....

- "How will Jay Powell ever live down the shame of presiding over an inflation surge that was no worse than other major economies' and then landing a 500bp tightening campaign at full employment and with inflation not far from the target level?"

- Extra points to Chair Powell for correctly pronouncing "short-lived" with a long "i," in saying "The effects on inflation could be short-lived..." Adds to Fed credibility.

- "We could make a $100B investment. Those decisions are easy to make." -Warren Buffett at the Berkshire annual meeting, explaining the pileup of $348B in cash as a result of the lack of big, compelling opportunities. Adds that "not being fully invested" has provided ammo for big profits over time.

- Treasury Secretary Bessent today said two-year Treasury yields 80bp below the Fed funds rate signals "the Fed should be cutting." Last fall, he said the Fed has risked "the integrity of the institution" by cutting 50bp in September, before the election, when the 2-year was 175bp under Fed funds...

- Market back to the April 2 low, traders keying on the 'upside risk' of steady tariff backtracking that could, maybe, prevent the ugly survey trends from spilling into hard macro data. Still not up to levels that even those who view this as a bear market have said we could bounce to. But close...

- After a furious rally that’s retaken half the S&P 500’s total Feb-April decline, weighing a handful of encouraging technical signals against a narrowing window for tariff de-escalation that would spare the real economy serious damage. Weekend CNBC Pro column, free to read with email registration.

- What do you call two of the most volatile weeks in years, featuring a headlong flight from U.S. assets, the tape twitching to each policy headline then an equity rally of unnerving velocity that retook half the lost ground while leaving in place most of the confusion? The easy part. New column.

- "What happened was this. I had a hang-up on my machine, so I hit star-69. They said 'Hello," and I said, 'Who's this?'..." www.nbc.com/saturday-nig...

- Overnight update from #MysteryBroker: Says he thinks we're "probably in a bear market," but hasn't gone to a sell call. "Waiting for more of a rebound and more time to pass...We declined 20% within 7 weeks, and if this is a continued bear market we need to have more fake outs and more time to pass."

- "There are two kinds of people in this world..." Timeline serendipity...

- "So you're saying there's a chance?"

- Lot of yelling at screens as risk rallies on Trump verbally de-escalating re: trade/Powell. Sure, baseline tariffs will stay, he can re-escalate at will, etc. But S&P fell 8% to 5670 pre-April 2 when 10% tariffs was base case. Index still well under that and sentiment/positioning got washed out.

- A high-stress/low-conviction market in a downtrend but oversold with acute upside headline risk. If a Treasury secretary's leaked comments from a closed bank-client meeting ("China tariffs unsustainable") lead to an instant round trip, were they truly market-moving? S&P 500 vs. gold intraday...

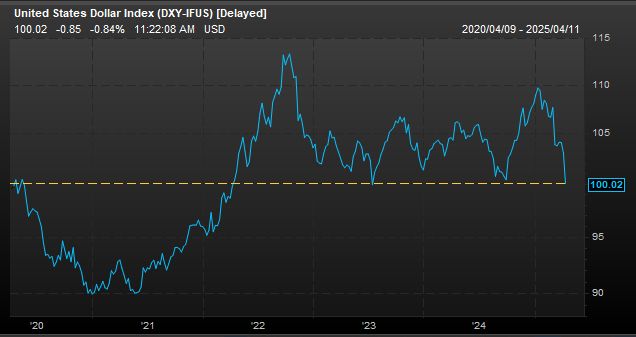

- Doesn't get much more neat-and-tidy than this in terms of "Will it hold?" thresholds, US Dollar Index at the floor of a three-year range, which was also the high of the post-Covid-lockdown burst higher.

- Reposted by Michael SantoliI know it’s not the point of the picture but I cannot let this slide.

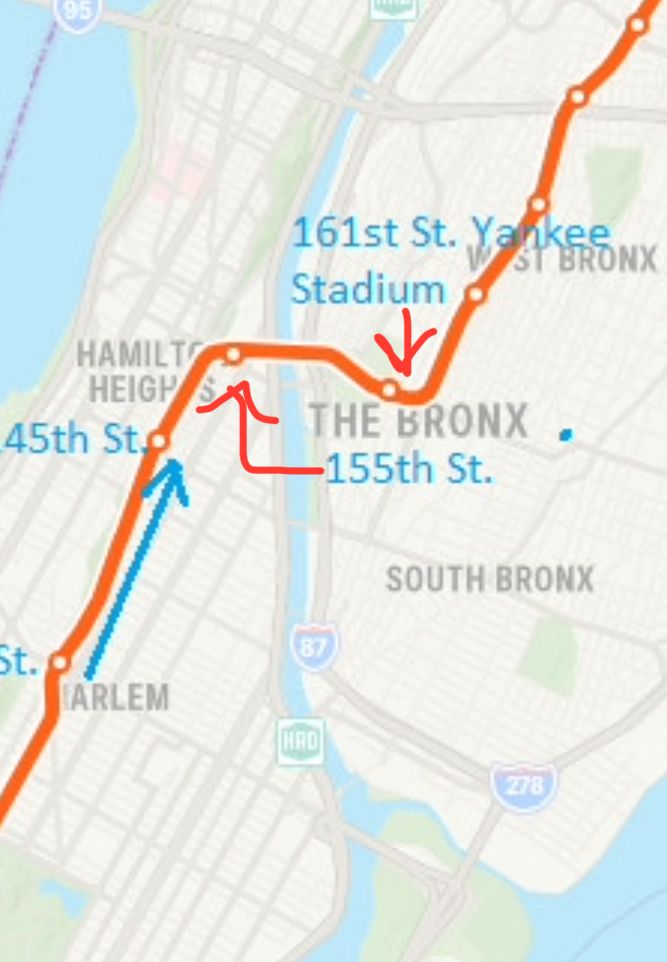

- They're using the D-line subway map to set the China tariffs, if we get to Yankee Stadium watch for the S&P 500 to break the morning lows. The end of the line is 205th St....

- The clock was ticking, the President knew what was ahead, the Masters starts tomorrow....