[Not loaded yet]

MMT started with a bond trader!

Warren B. Mosler in the late 1990s started writing how he believed money worked.

Stephanie Kelton then wanted to show him how he was wrong and did research and a paper on how he was wrong, but the more research she did the more she realised that Warren was right!

You are arguing against something you have very little knowledge about!

Kelton then developed those concepts into a book for the general public on MMT - The Deficit Myth. It's an awful work, which is wrong on both the facts and the critique.

It's obviously true that money in the current world differs markedly from when it was based on gold and silver - but this has been the case for a century or more. It's not news.

Despite that, sensible governments still act as if economics still broadly operates within that framework, as it does.

In particular, while Kelton spends ages banging on about the NAIRU (a bodge to a behavioural hypothesis which had broken down and which is itself largely discredited and unused now), she doesn't reference the Philips Curve it builds on.

It's a straw-man argument.

Even more tellingly, she doesn't reference the (true by definition) MV=PT classic monetary equation. That's a massive problem because the whole notion that you can print your way to prosperity as long as you don't overheat employment flies in the face of it.

If you want MMT to be taken seriously then it needs to either accept classical monetarism and work within its framework, or else take it on and expose the flaws in its theory and operation. Melton does neither - presumably because she can't and doesn't want the inconvenience of it showing.

There are similarly deep flaws in her understanding of the flow of money and of how borrowing and bonds work, though these generally all lead back to the point that even if you can technically do things with monetary instruments, the fundamental laws of economics still apply.

If we take MMT's assertion that the purpose of tax is to withdraw money from circulation to prevent inflation rather than to fund government (it's not: it couldn't be so fine-tuned even if it was), and integrate it with the print/withdraw model, we just end up back at classical monetarism anyway.

So either MMT is just a different way of interpreting the same thing - because the bounds of scarcity, production and demand are what really limit an economy - or else it is simply wrong in its critique, analysis, model and conclusions.

Given the policies its proponents advocate, it's the latter.

MMT = magic money tree

Here is a very simple question:

Where does the money come from?

If Scotland decides to declare independence and use it's own currency, where does that come from?

What a terrible decision. But sure, it creates one. Prints as much as it likes. Prints more and more to make sure everyone can have as much money as they can hold.

Which will be essential because you'll need buckets of notes to buy bread. The "money value" of Scotland ain't set by Scotland.

So you don't know anything about MMT then?

May 14, 2025 12:31More than you, it seems.

So where does MMT say you can just print as much as you like.

I don’t want opinions, please provide links.

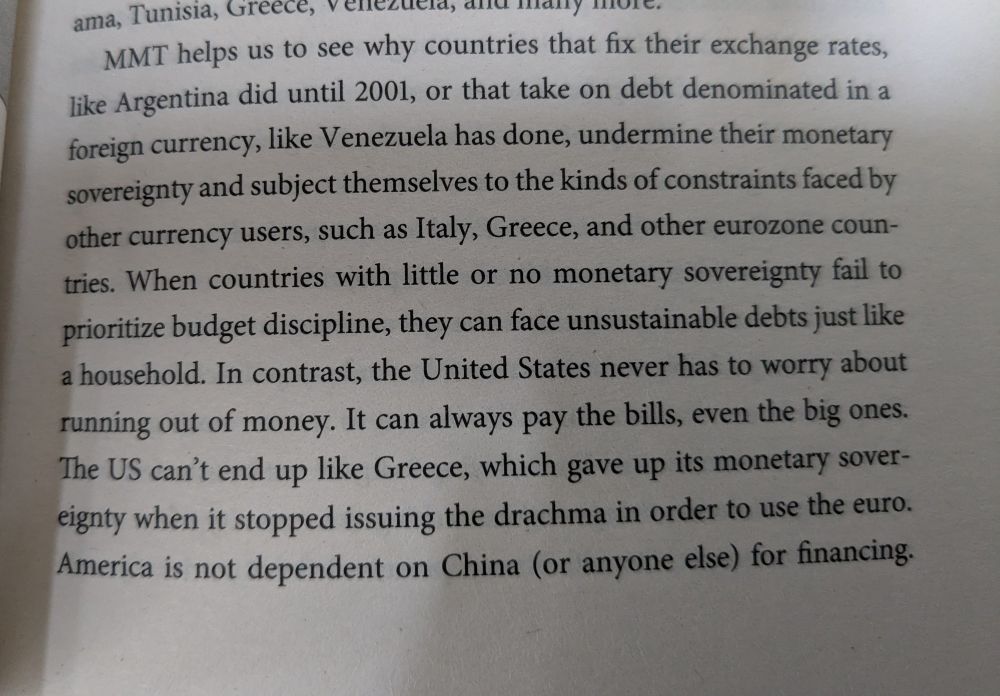

It's implicit throughout, particularly in the sections dealing with full employment, but from a brief scan, this section on pp19-20 effectively says that:

I recommend you read chapter 5.

Even though I did say give me a link, and you gave me a screenhot, I have to be honest when I say taking things out of context is not going to prove your point.

I've read the whole book, thanks. The introduction sets out the broad concepts of MMT and the screenshot isn't out of context.

I suggest we leave it here. We're not going to agree.