Jason Furman

Professor at Harvard. Teaches Ec 10, some posts might be educational. Also Senior Fellow @PIIE.com & contributor

@nytopinion.nytimes.com. Was Chair of President Obama's CEA.

- The one thing that is clear about the US-UK trade deal is that the gains to both the US & UK from the UK's increase in market access are much smaller than the US & UK losses from the large increase in U.S. tarrifs relative to 1/19/2021. Plus other agreements likely harder.

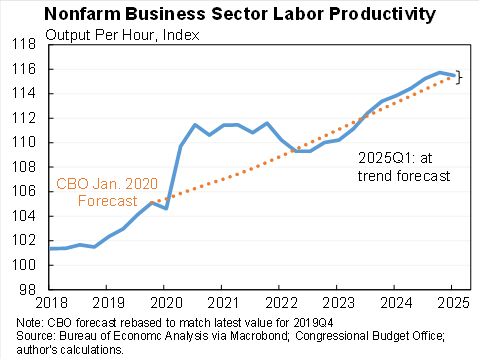

- Productivity growth for Q1 came out: -0.8% at an annual rate. Don't think of that as technological regress but as the residual to what was either a large temporary demand shift or demand mismeasurement. Overall productivity is just where CBO expected it to be be pre-pandemic.

- Reposted by Jason FurmanI think this quote from @jasonfurman.bsky.social does a good job of explaining why the Fed will remain on hold for at least a few months: “The best thing for the Fed over the next few months is to be behind the curve, because the alternative is to risk being ahead of the wrong curve”

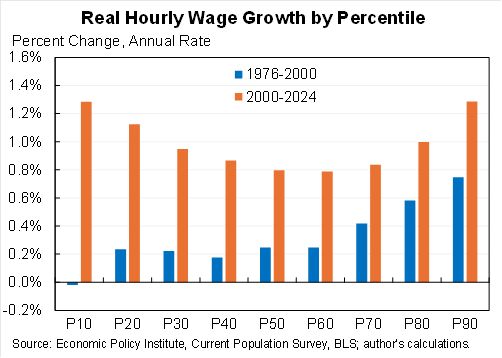

- How wage growth in the last quarter century compares to the quarter century before it: discuss. ["Quarter century" being 24 years]

- I discuss what the Fed does next (spoiler alert: my view is nothing until the data is clearer) in @nytopinion.nytimes.com together with Oren Cass & Rebecca Patterson. www.nytimes.com/2025/05/06/o...

- Reposted by Jason Furman[Not loaded yet]

- My latest @nytopinion.nytimes.com makes a point that is obvious to economists but that many non-economists fin surprising and unintuitive: raising the budget deficit--which the Congress is working on doing by $7T--would also raise the trade deficit. www.nytimes.com/2025/05/03/o...

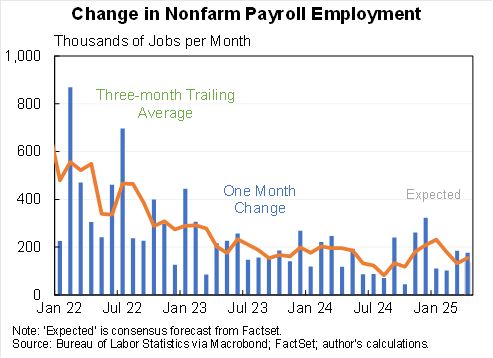

- Strong jobs report. 177K jobs added. Unemployment rate steady at 4.2% but participation rate up and U-6 down. Hours steady. A slowdown in hourly wage growth.

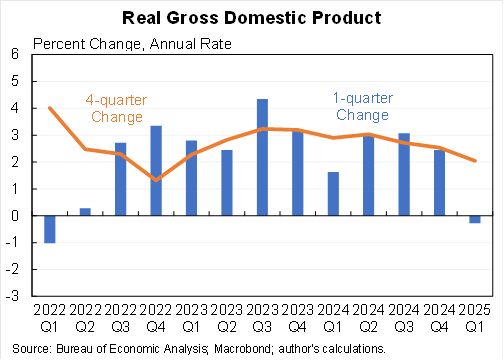

- Today’s GDP number, like always, will be revised many times in the coming years with better source data. Based on historical revision magnitudes there is a 49% chance it gets revised to a positive—but also could be more negative. Here is what the “final” number could look like.

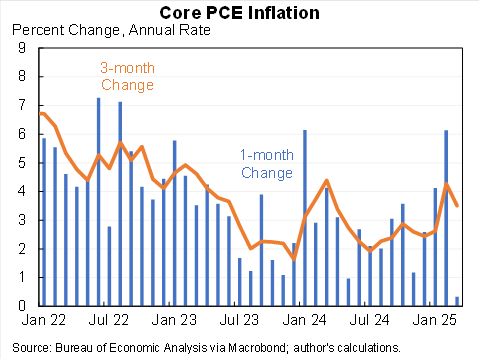

- Core PCE inflation tame in March but a bit above expected. Inflation annual rate: 1 month: +0.3% 3 months: 3.5% 6 months: 3.0% 12 months: 2.6%

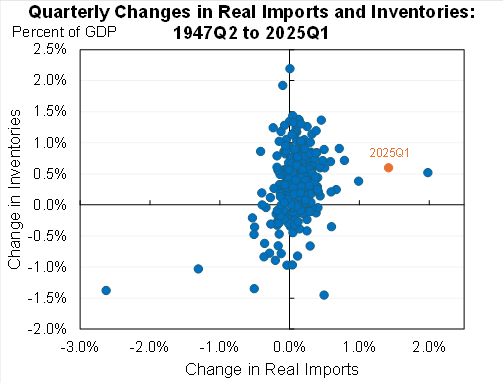

- One illustration of just how extreme the numbers were this quarter, it was the second largest increase in real imports as a share of GDP ever recorded (2020-Q3 was larger). Inventory increase was on the high side but not remotely commensurately high.

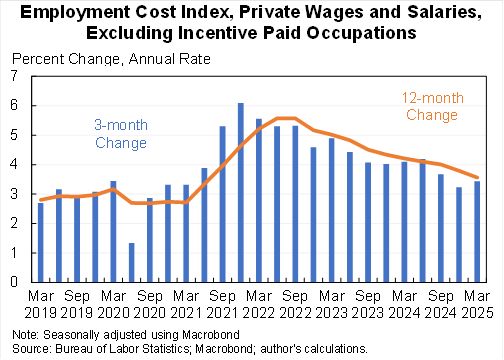

- Not the most exciting data of the day, but private wages ex incentive compensation occupations up at a 3.4% annual rate according to the ECI. A slight bump up but longer trend is still down.

- Real GDP fell at a 0.3% annual rate in Q1. The underlying numbers are very extreme--with an enormous increase in imports and inventories. My preferred measure of "core GDP" a better signal, up at a 3.0% annual rate (see next)

- I'm in @ftopinion explaining what I'll be looking for in tomorrow's GDP release. There will be much more real & measurement error noise than usual do to massive trade timing shifts so critical to look at "core GDP", which is the sum of consumer spending + fixed investment. www.ft.com/content/5857...

- Wednesday's Q1 GDP # will have a lot of economic noise, a lot of measurement noise, and could generate even more political noise. A technical🧵on one aspect: what period does it reflect? The answer is a combo of pre- and post- 1/20 because of the weirdness of quarterly averages

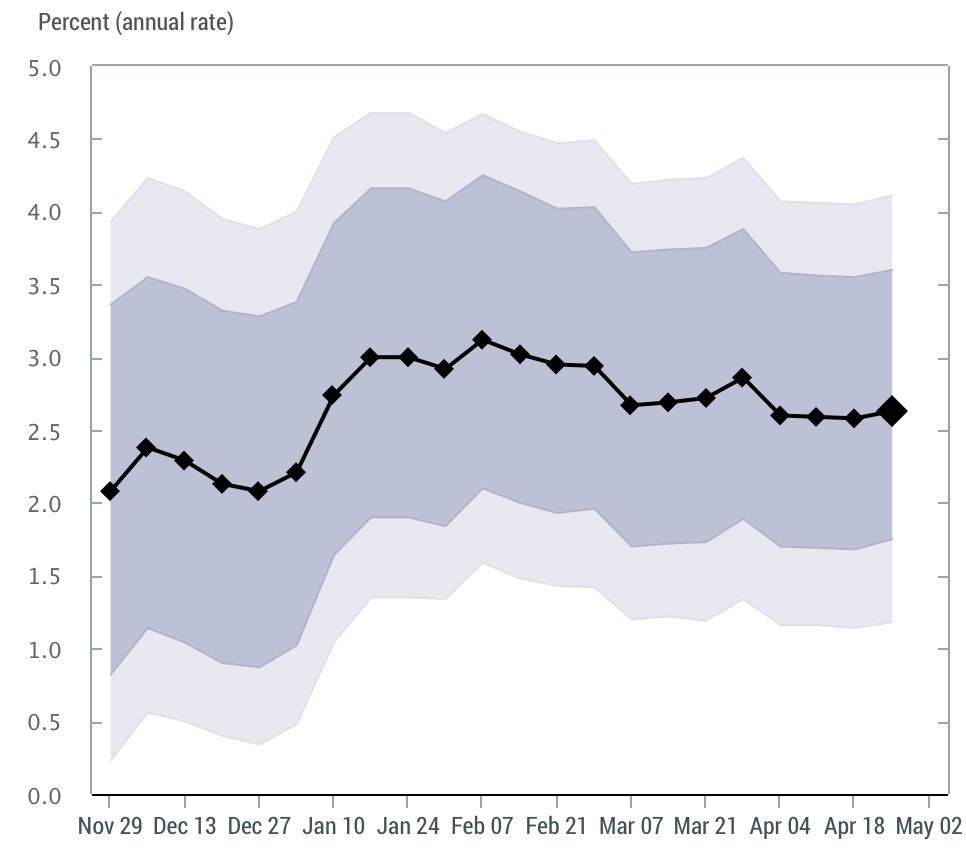

- Does anyone know anything about the track record of the NY Fed Nowcast for GDP? They're currently forecasting 2.6% annual rate in Q1--while most other trackers are in the -0.5% to +0.5% range.

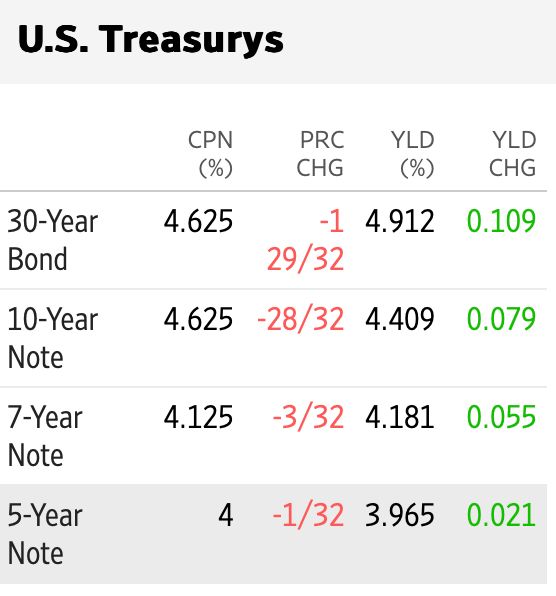

- To state the obvious, the President's Fed bashing is raising long-term interest rates (operating through the risk premium). This will raise mortgage and other borrowing rates and be contractionary. The wealth effect from a falling stock market also contractionary.

- I really liked Gary Gerstle's "The Rise and Fall of the Neoliberal Order" even if I mostly disagreed with it. A longer-than-usual Goodreads review: www.goodreads.com/review/show/...