Aleksandar Hummel

A disruptor and an optimist.

Somewhat funny,

Entirely serious.

Opinions my own.

Litter-free:

linktr.ee/haleksandar

- [Not loaded yet]

- [Not loaded yet]

- My own 2c, that I share out of a sense of importance, are that welbeing emerges out of an efficient economic system and that a balance of migration can be achieved through such efficiency all the while minding sustainable resource use.

- [Not loaded yet]

- Ponzi promise.

- National debt is one of the most debated—and misunderstood—topics in economics. Everyone screams "Cut the debt!" but almost no one explains *how* that would actually improve the economy or make society fairer. 🤔 #EconSky

- [Not loaded yet]

- You did not study my previous response to you sufficiently. bsky.app/profile/hale...

- On back of a question (bsky.app/profile/erni...) here I turned to how "edges" form and Charly Munger's thought. A page (fs.blog/mental-models/) offered a synopsis of "mental models" being great but for its bias compelling me to annotate it (below), and hence repeat: the dominoes must fall. #EconSky

- I discuss long-term economic trends and socio-political issues in reference to current junctions, visiting key distinctions and new paths toward historically elusive progress. haleksandar.wordpress.com/2025/05/05/d... #EconSky #greedflation #ethics #anti-fascism #3E #TeslaTakedown #EndOligarchy

-

View full threadSo: effective redistribution of some part of wealth to increase demand, grow diversity and direct competition as drivers of progress or defence of Gresham's corruption? Left vs. right? Which are you? Why? Note I use the quotation marks above in my own sense. I find rigorous statements necessary.

- Not to disparage Charlie nor his wisdom (fs.blog/great-talks/...) but fundamentally to disagree to the nature of life being an "ass kicking contest". And to state, accordingly, the value of investment management as aligning term and views.

- Hanlon's razor -> much like Occam's it can have exceptions but /don't look for those first/. In a game-theory sense shifting response form malice to stupidity/incompetence allows the populist right grip on power. Incompetence an excuse, knowing better impossible, they press on with "pure" intention.

- Red queen effect -> it's not discussed who escapes it. Diversified holders of capital. Holding /all/ assets they benefit, collecting rent, doing nothing as system tunes itself. There's a difference between retirees and an oligarchy. These are two clear and distinct categories the system can support.

- Gresham’s law -> "Bad drives out good. But in the long run, true value wins out." This is a clear hokum. There's nothing necessitating "true value wins out in the long run." Think about it. First it states odds are skewed in favour of the corruption. Then that good will prevail. Really? How so?

- This hanky-panky serves to deflect consideration something should be done to detract the corruption. It serves to preserve a system in which any force of progress indeed must bear the full weight of the tides of decadence. It serves to hold in place the "capitalist" creed above.

- Monopoly and competition -> the quintessential "capitalist" absurdity: "the ideal is a balance - enough competition to check monopolies but enough monopolies to reward innovation." This is saying that concentrated capital and only concentrated capital has the right to leverage (and ration) progress.

- The system can not be skewed so to make it easier for the able and competent to get ahead, especially not for the talented in mischief. It must be the opposite, if it's to be sustainable and just, if it's not to draw discontent and rebellion, if it's not to fall toward propaganda and tyranny.

- Bitcoin doesn't promise returns. It offers freedom from rulers who control the money. #bitcoin #btc #crypto #cryptocurrency #econsky

- Bitcoin replaces the rule of law with caprice of future generations.

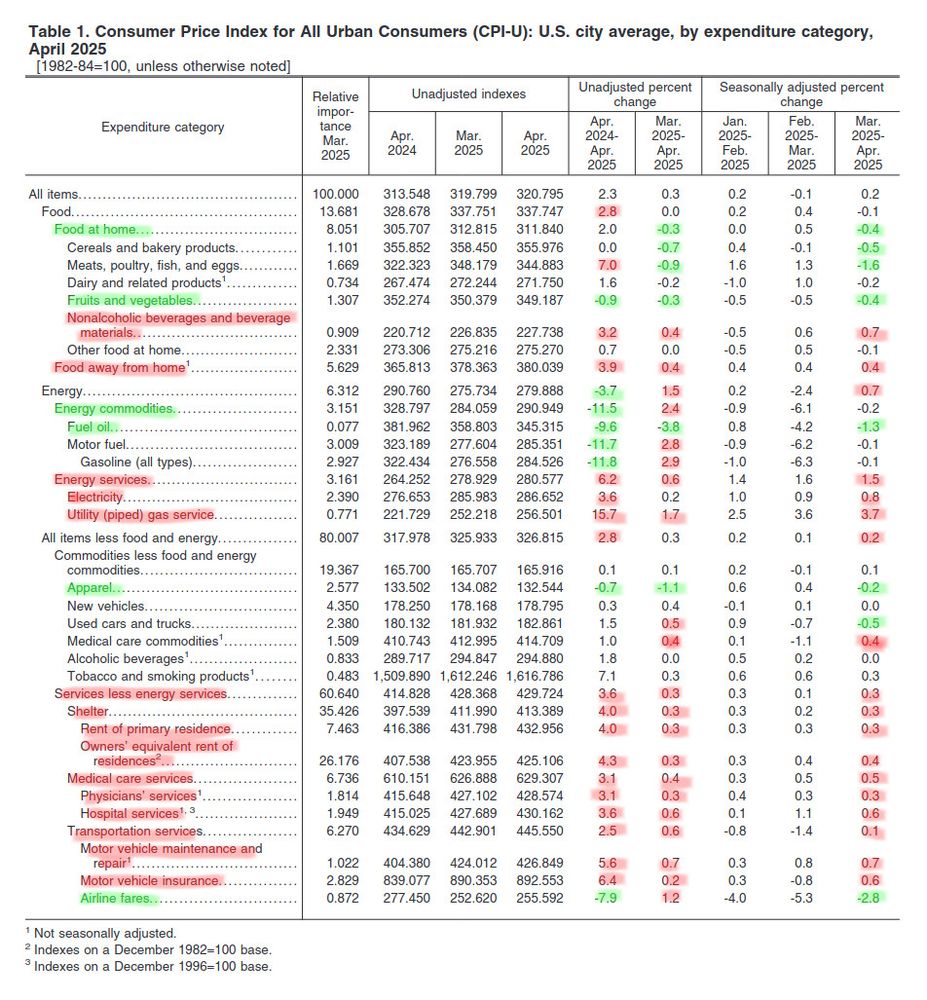

- Americans are paying more taxes in the form of tariffs. But are these the right taxes on the right people? #EconSky

- These are taxes on everything and everyone. To start or run a business imported capital equipment is taxed. Raw materials too. More expensive consumption means wage expectations rise. All enterprise in U.S. becomes less competitive. USD devalues. Inflation. Lower real income. Making everyone poor.

- Government collecting tax to pay interest represents a transfer of benefit (welbeing). When this is excessive productive capacity of society diminishes in favour of those collecting rent. At some point this becomes unsustainable.

- [Not loaded yet]

- First week is your physical withdrawal. Headache, lack of focus, tired/easily irritated. Best take off work. Then for a couple of weeks you catch up on sleep but feel tense. Best work light. After you've about six months of psychological withdrawal thinking how you miss the sensation.

- Then you sleep better and realise you're fine having natural energy and a steady pulse.

- [Not loaded yet]

-

View full threadSecond, amalgamation of the two presenting a barrier to change in distribution of welbeing. This isn't to say anything to the character of "times", but finds it necessary to recognise as-is our system is more arbitrary and hence less agile and conductive of progress than it could be.

- So you're looking for literature to the nature of economic, and political systems focusing on the transfer of welbeing. I'm not sure if this has been explicitly studied. Maybe try studies of market microstructure, psychology and entrepreneurship - exploring how "an edge" develops and is exploited.

- [Not loaded yet]

- This idea is an extension of the thought that winning the market competition leads to wealth ("capital"), and influence (i.e. "power"). I find two observations critical here. First, excessive concentration of either in leading to outsized control over the course of society is undemocratic.

- Some buy Bitcoin to get rich. Others buy it to get free. #bitcoin #btc #crypto #cryptocurrency #econsky

- In Soviet Russia the Sun has a B sign across it.

- And kids stare into it.

-

View full threadThese share the same bet that there will in the future be more inflows than outflows. That and only that's what you're buying into when subscribing to #bitcoin propaganda of guaranteed returns. 500k? Million? Sure. Difference being guarantee of law and legal exclusivity, in place of tech fantasy.

- Think, once everyone puts all their money in and money needs to start coming out what will happen to value? Who'll you get to pay into such a system bringing *nothing* but transfer of benefit from payer/buyer to payee/seller? Crypto is fascist-communism. Buy into it, don't be surprised by decadence.

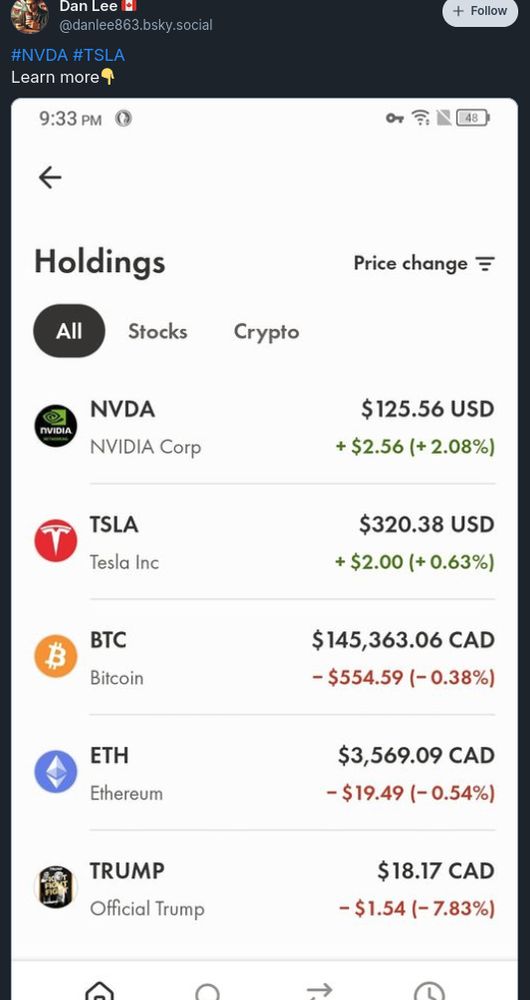

- You forget $100K well funded propaganda and Trump regulation but you definitely have a point, no arguing with demigod Minotaur here.

- So correction here more to the point for the benefit of future readers, is who'd get the idea to buy literally 'nothing' with their money, who'd buy into a Ponzi scheme if it weren't advertised? Consider. If you think Social Security is a Ponzi scheme you're obliged to believe #bitcoin is one too.

- Trade deals with oppressive autocracies is not particularly exceptional. Sadly American, but not exceptional. #econsky www.bloomberg.com/news/article...

- Sometimes the Saudis have to make a trade deal too, I don't hold it against them. I know, I get your vibes. Most things Trump does are sad. Some beyond sad. But most sad. Very sad.

- "Move after stronger-than-expected growth in cloud-computing business Azure and blowout results, calming investor worries. But cost of scaling AI infrastructure weighed on profitability, with Cloud margins narrowing to 69% from 72% y/y." Satya not getting sloppy. finance.yahoo.com/news/microso...

- Big meetup, on trail of TSLA bid. I wonder if Saudis like ChatGPT more or Grok. AMZN cloud too. Capital goes where there's cheap labour and no tax. Guns for oil and funding. Also, names of gulfs (it's "Arabian" now) and who's who. (Welcome, Syria.) To live is to serve. www.bbc.co.uk/news/article...

- Seems way too simplistic an analysis. It’s primarily a tax on businesses that offshore labor to encourage businesses to onshore labor. How it will impact behavior of businesses and consumers is till unknown. It’s not just a math equation. #econsky

-

View full threadFirst government has to want to solve the problem then it can find a way. Conversely it can misapply any tool in a convoluted way and feign surprise or act denial when it doesn't work or rather works for its benefactors. I've said myself subsidies aren't much better - but are better than tariffs. /2

- In my own view the economy on aggregate generates some amount of profit that's distributed between corporations and employees. That's the nation's income. If we subscribe to the notion of progressive taxation that income should be taxed so to the concentration of it. Take big techs acting as a sink.

- [Not loaded yet]

- [Not loaded yet]

- Profits private.

- That would be part of the analysis. Some components have been offshored for things like pure labor arbitrage, but other things because there is natural comparative advantage. Sadly, much corporate offshoring is done for labor, environmental and tax arbitrage. No bueno. Again, not just math.

- Not disagreeing with you things can improve but tariffs are not the tool. It's like chemo only worse.

- It's (Trump) regulators (and major beneficiaries) are not.

- Echm..no. It's a tax on everything any business imports. Every component that goes into anything made in U.S. and all capital goods purchased from abroad when starting or running a business. It's increased input costs and directly makes the U.S. economy less competitive. Planning complete DIY?

- These extremists literally are advocating fending off less fortunate nations left to their own devices, within their right - but must be called out. The tacit racism in assigning blame to countries where migration originates just as wrapping the discourse in a liberal tone are abhorrent. #EconSky

- In the top half rules that indeed, no one is obliged to follow (in the economic sense). So no rules at all. And hence hidden rulers lurking in shadows. More like below image suits when grown up. "Rulers" below indeed steer a dynamic system. Lots of cash's not for long hold, this every child knows.

- [Not loaded yet]

- [Not loaded yet]

- Your "addressing" of the issue is extremist, is the issue. Concerns dismissed are not concerns appreciated.

- This is what people voted for. Woman home keep child. Man work in detention center. Nukes for safety. Need not even army. Better. Man not train for war. Efficient. Most efficient for economy. New investment in underdeveloped areas. Good returns.

- This is diabolical. It shifts focus from economic progress by means of innovation and search for more efficient use of resources and materials directly toward confining migrant populations left to their own resources and philosophical pondering resolving to energy use.

- Here (finance.yahoo.com/video/fed-fi...) is Trump Media pondering FED reform on behalf of congressmen: "why there has been such sudden sell-offs in Treasuries and what can be done to mitigate that volatility?" Go on, fix the symptom don't even think about the cause. Mandate ycc, why not? #EconSky

- Ultimately, it's not like this is an immediate problem. Once it becomes relevant to fix like now Social Security I reason it will be possible to favourably resolve it without material consequence to the economy.

- [Not loaded yet]

- What is "SEC"? In answer to your second question it's because markets are regulated so to protect retail investors from losses in leveraged derivatives markets by limiting their access to these.

- Once you dumb trading down and make the only tool available outright L/S then every problem becomes a nail. Without leverage everyone is equally insightful. Markets become meme. Thank you, regulators. For keeping us safe, and prosperous. #EconSky

- I mean, not that this matters at all.

- CPI (www.bls.gov/news.release...) quite opposite of "practically everything down", really. Reversal of prior month cooling. Up: services, insurance, shelter, m/m utilities. Down: y/y energy (Saudi glut, mild winter?), "food at home" (held up exports?) Tariffs: med. cdty's and bev. mtl's? #EconSky

- Notably: "[y/y] the eggs index increased 49.3 percent". But this doesn't really matter. Neither does US10Y hitting 4.50% nor future mortgage rates.

- I'm now calling this the "nothing really matters" rally. Meme markets for everyone.

- [Not loaded yet]

- Come think of it in few years people may go back and say ... 'ey membr hows crypto gr8 b4 it was reglated?

- [Not loaded yet]

- This doesn't matter.