𝖠𝖽𝖺𝗆 𝖲𝗁𝖺𝗉𝗂𝗋𝗈

Macrodata Refinement

Views are my own | Private account

- While Medicaid is clearly better than nothing, it is a definitively worse than Medicare in terms of quality of care www.frbsf.org/wp-content/u...

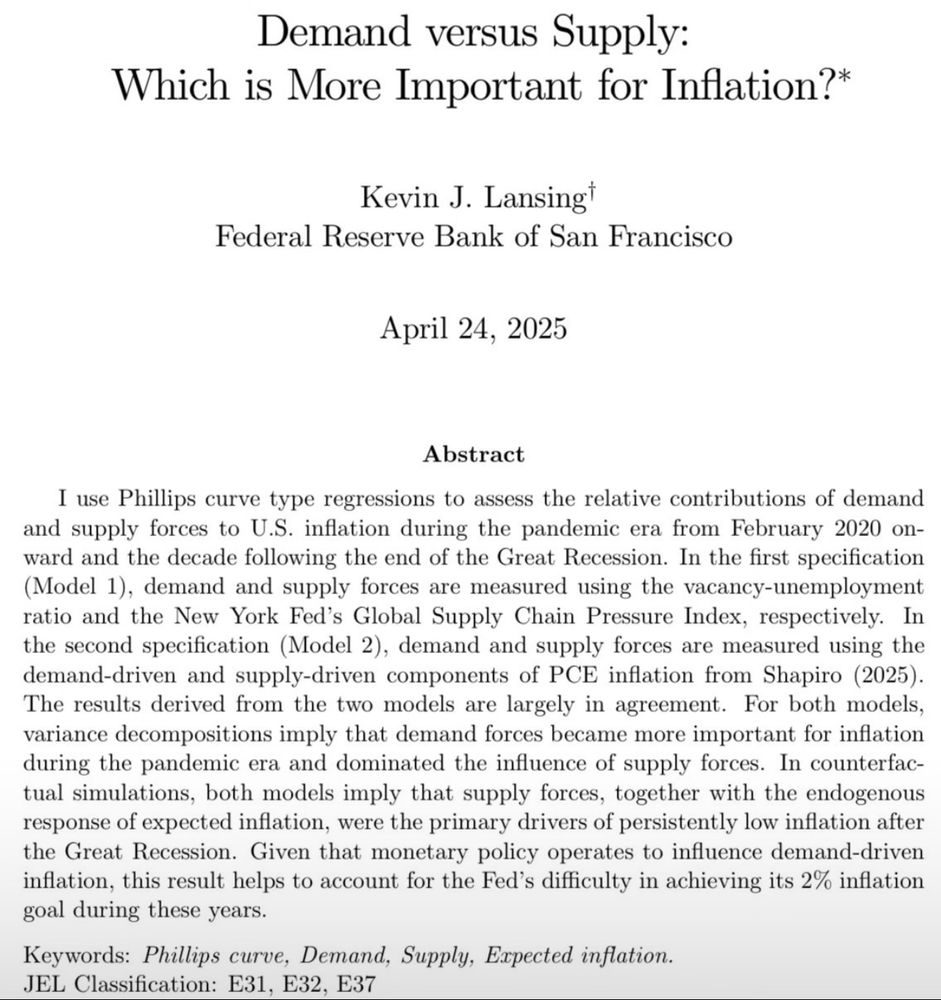

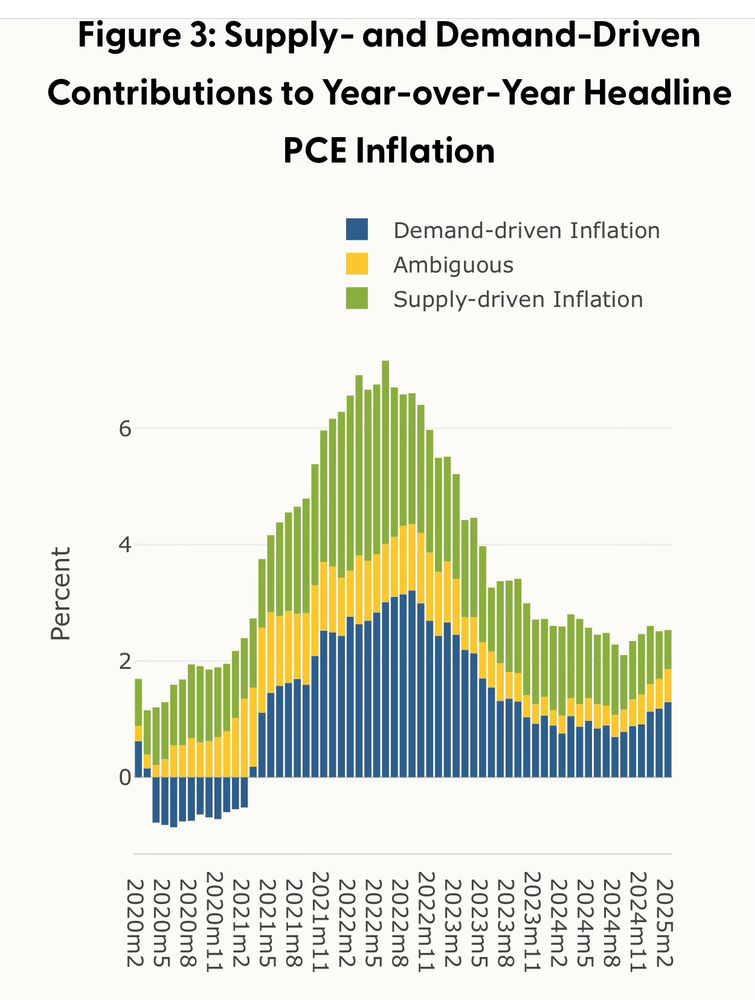

- While supply factors kept inflation low in the mid 2010s, demand explains most of the variation in inflation during the post-pandemic inflation surge. www.frbsf.org/wp-content/u...

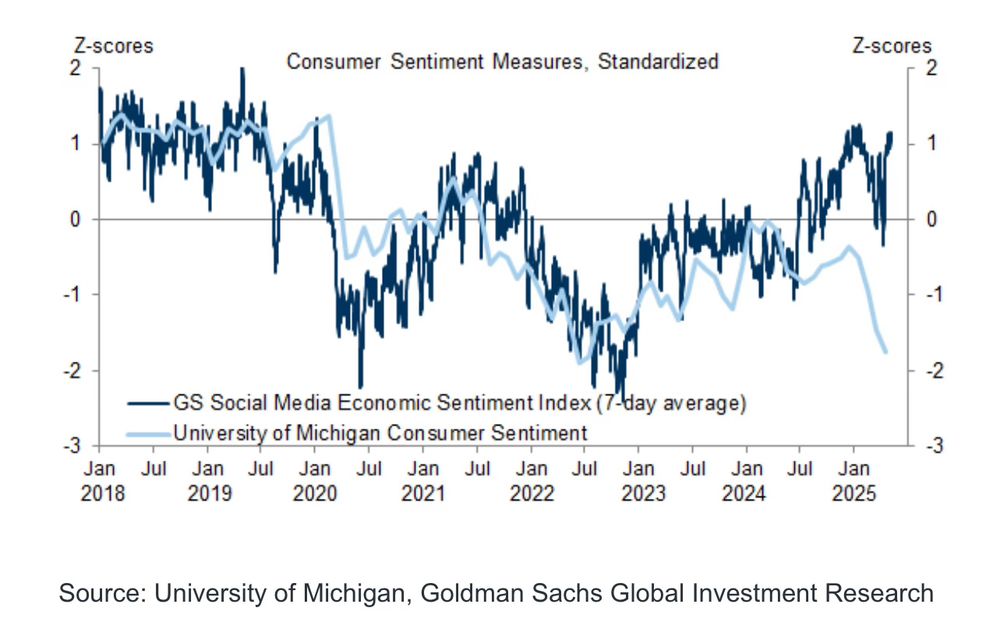

- Twitter and consumer sentiment have officially decoupled

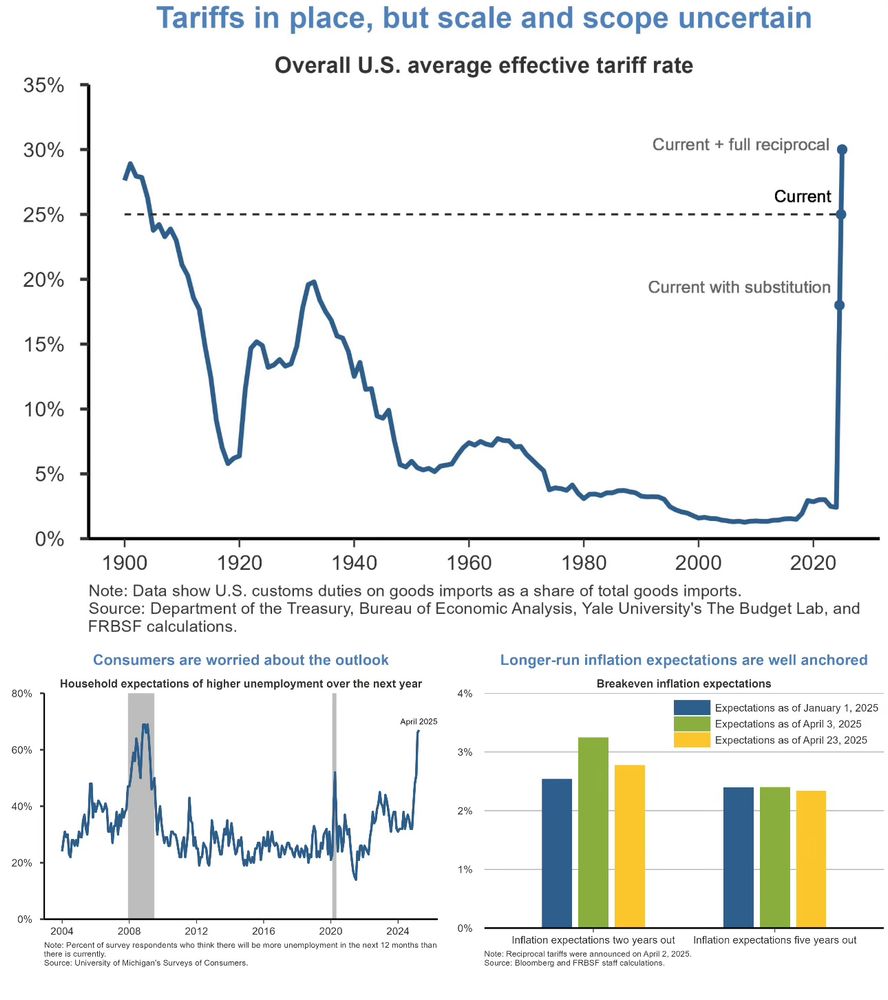

- A highly relevant paper by my colleague Mauricio Ulate, and coauthors Andres Rodriguez-Clare and Jose Vasquez assessing the consequences of the recent tariffs. U.S. real income falls by 1% by 2028, with some states having declines of more than 3%. www.frbsf.org/wp-content/u...

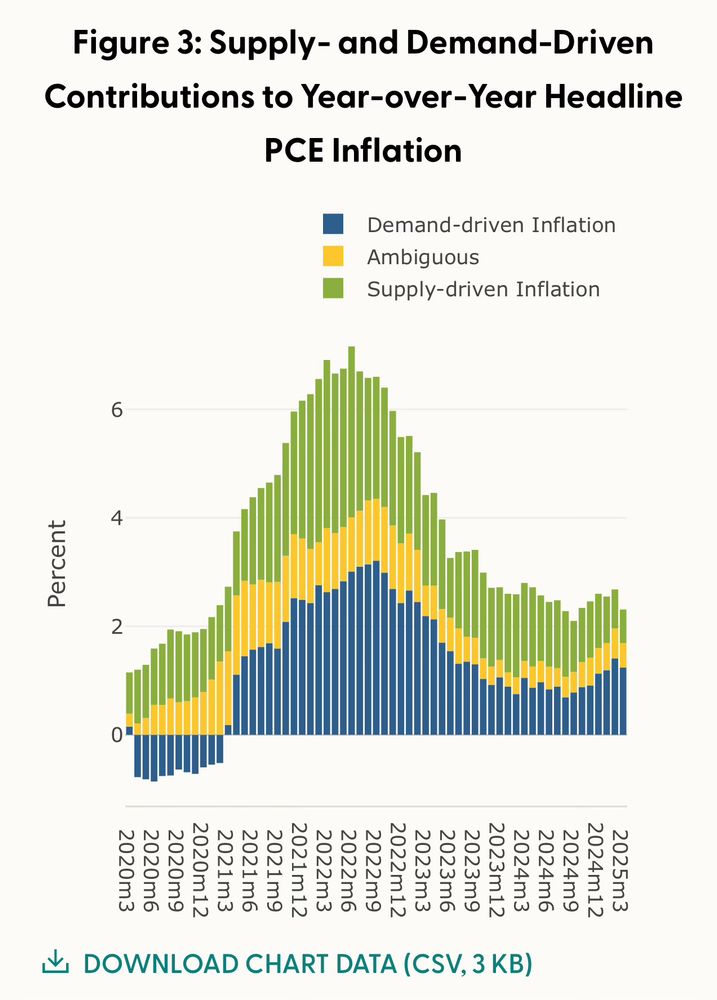

- As of March 2025, supply-driven inflation was at its lowest since before the pandemic www.frbsf.org/research-and...

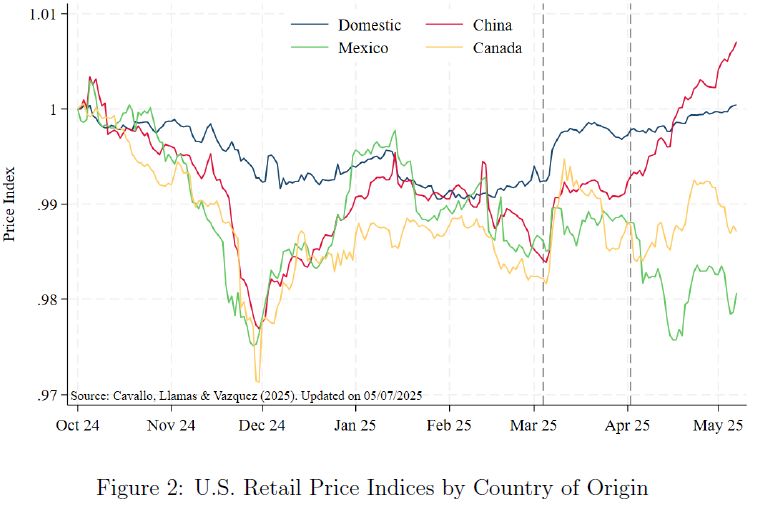

- Interesting work by Alberto Cavallo and coauthors looking at real time retail prices of imported goods (country of origin identified using AI) pricinglab-rw7gfm.s3.us-east-1.amazonaws.com/tariffs/Trac...

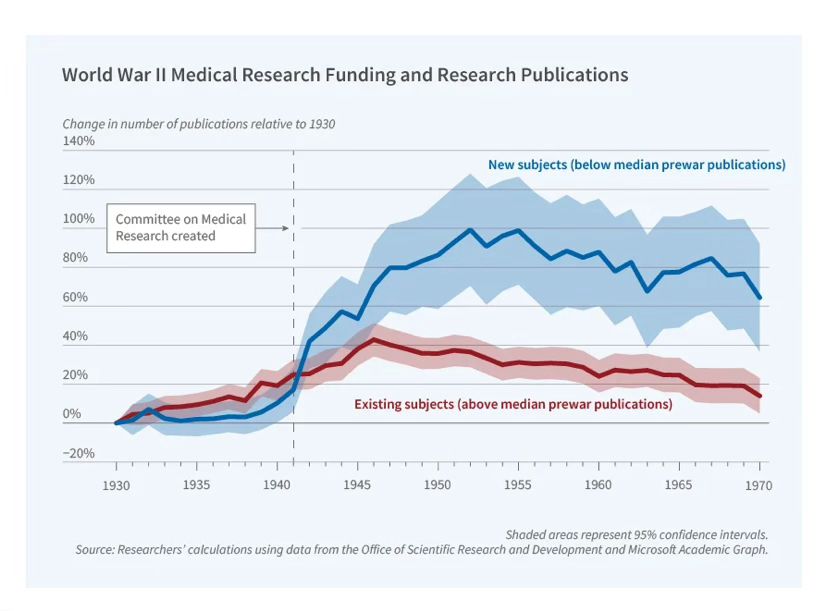

- Government funded research is imperative! www.nber.org/digest/20250...

- “People's negative sentiment seems to be driven by the perception that incomes have not kept up with prices, even though real spending has increased, and by the effort they exerted to adapt to rising prices” www.federalreserve.gov/econres/note...

- The share of U.S. consumers who anticipate higher unemployment over the next year has risen of late, and overall sentiment levels have declined. Household expectations of losing employment can lead to higher levels of precautionary savings and a dampening of consumer spending.

- The persistence of the east/west divide in Germany is striking. Even in Berlin

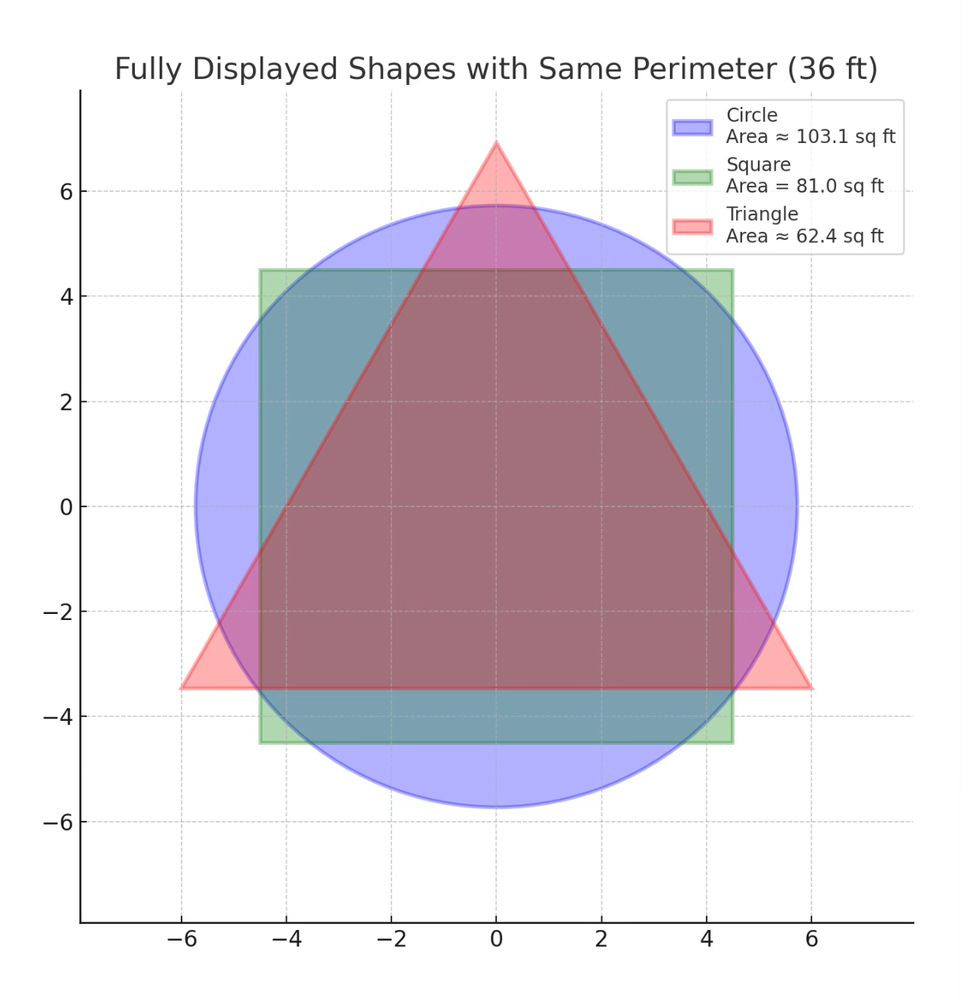

- Love this question from my 9 year old’s homework: you have 36 feet of rope what shape gives you the largest area. Here is chatGPT’s visual

- An increasing number of Americans are worried about losing their jobs www.frbsf.org/research-and...

- Economic news sentiment has fallen a lot since last Fall, but is currently not as low as I would expect given all the other sentiment indicators. (It was considerably lower after SVB) www.frbsf.org/research-and...

- Check out the newest SF Fedviews www.frbsf.org/research-and...

- “Overall prices rose modestly, and price pressures intensified for a wide range of imported goods and materials. …sentiment and the economic outlook worsened materially relative to the prior reporting period...” From the SF Fed’s April 2025 Beige Book www.federalreserve.gov/monetarypoli...

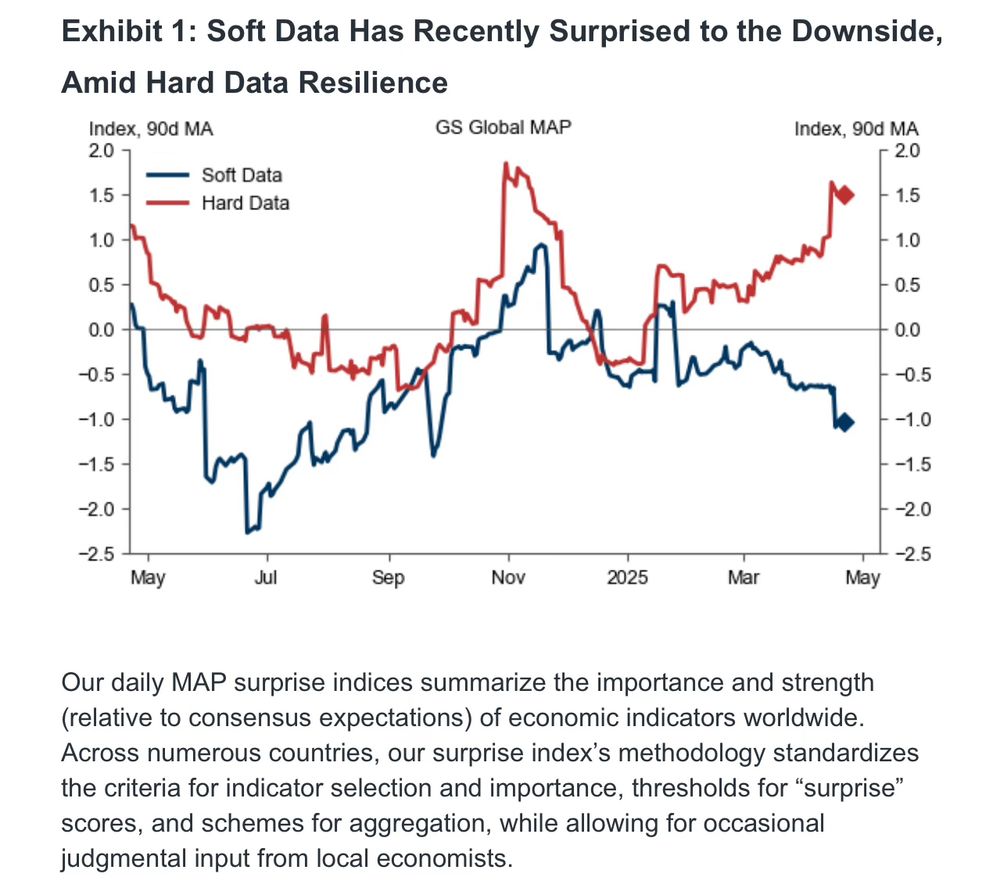

- Soft data (e.g., sentiment) is thought to be more forward looking

- Random bagel place i stopped in nyc has better bagels than anything in Bay Area

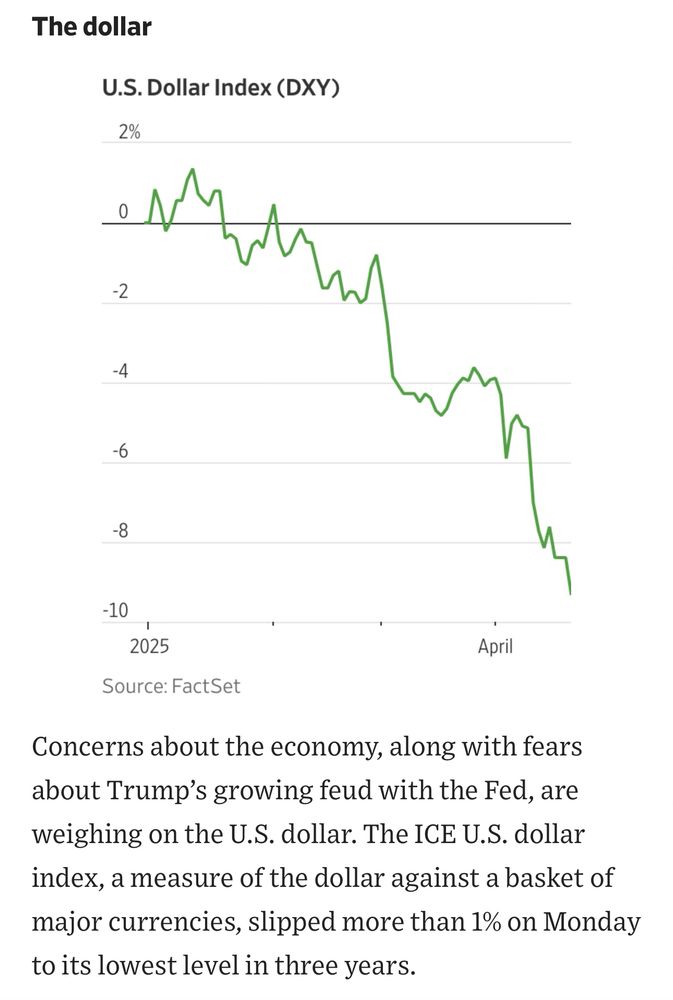

- During most periods of financial volatility the dollar appreciates (not this)

- Reposted by 𝖠𝖽𝖺𝗆 𝖲𝗁𝖺𝗉𝗂𝗋𝗈[Not loaded yet]

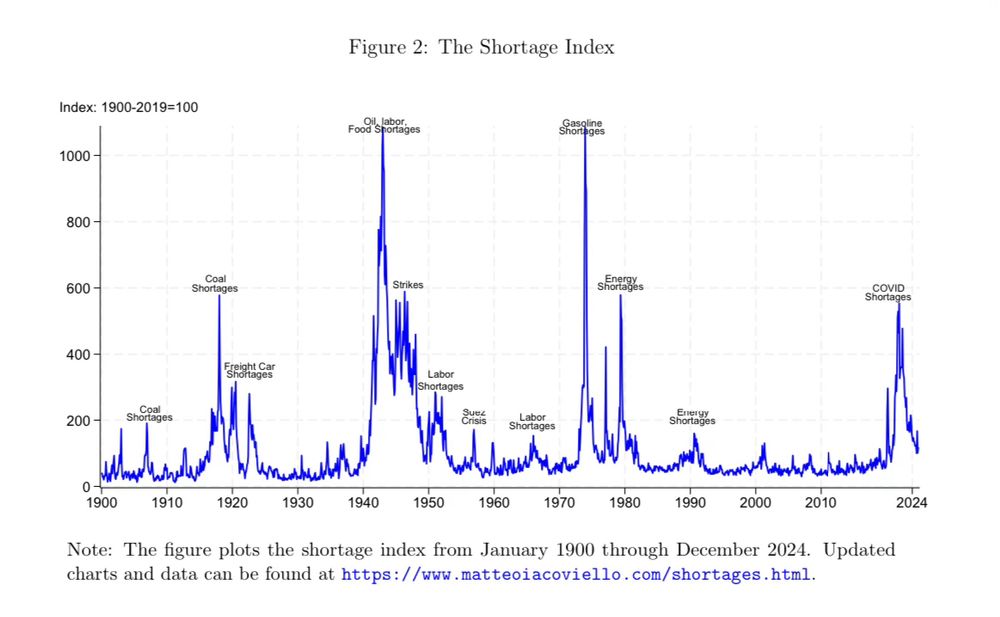

- This paper by Caldara, Iacoviello, and Yu is super interesting. The oil shortages in the 1970’s and 80’s were huge! www.matteoiacoviello.com/research_fil...

- No, this is called the “real wage” Strange op/ed www.wsj.com/opinion/we-s...

- Layoffs remain low, but hiring is cooling www.frbsf.org/research-and...

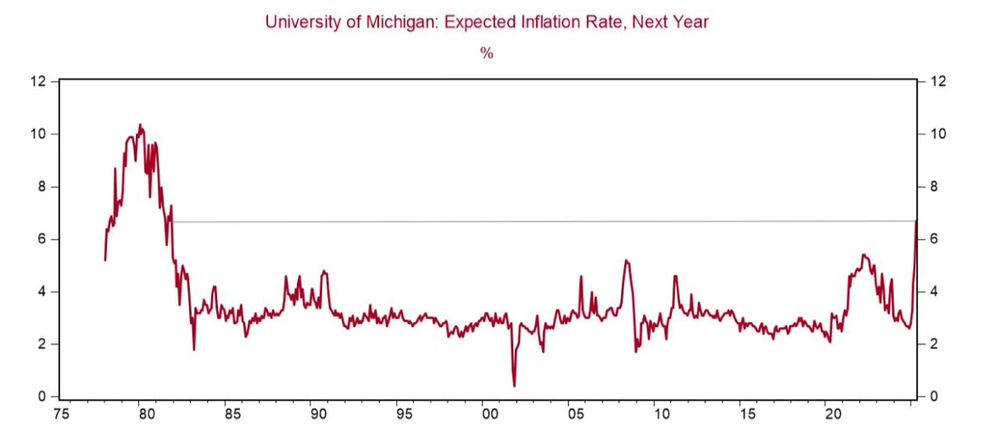

- Consumers are expecting inflation to reach 6.7% over the next year, according the University of Michigan's Surveys of Consumers. This is an exceptionally high reading, significantly higher than during the pandemic.

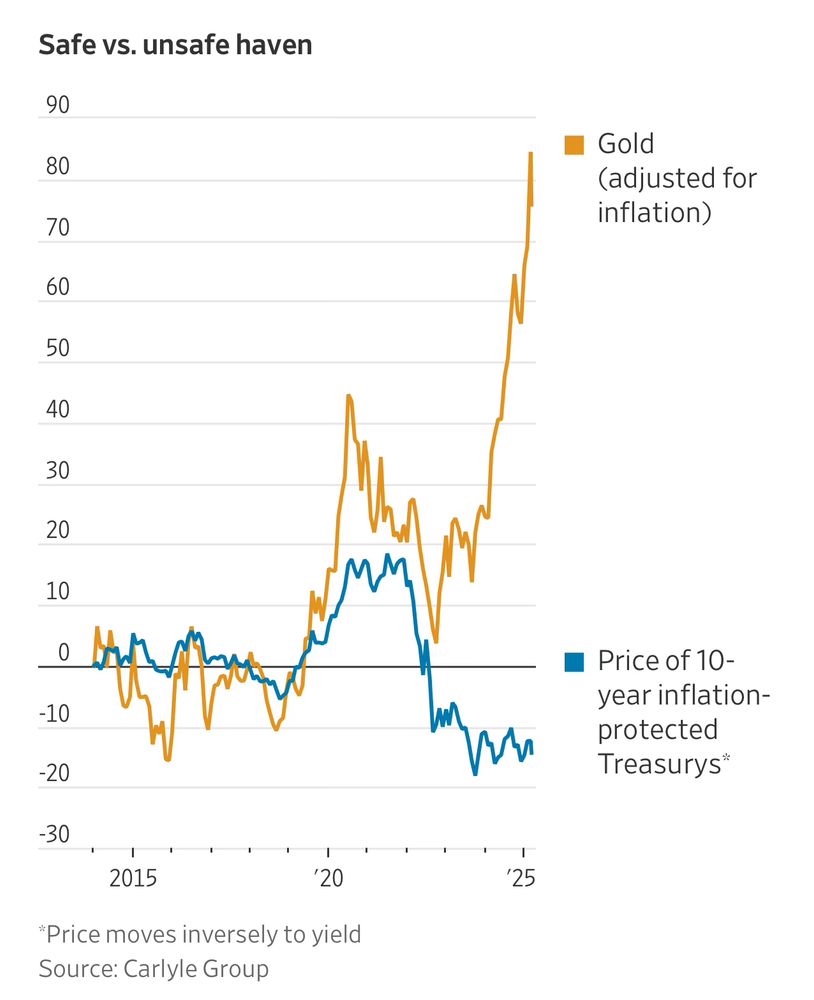

- What a chart! www.wsj.com/economy/trad...

- Supply-driven inflation has been creeping up the last two months, suggesting that businesses may be raising prices in anticipation of tariffs

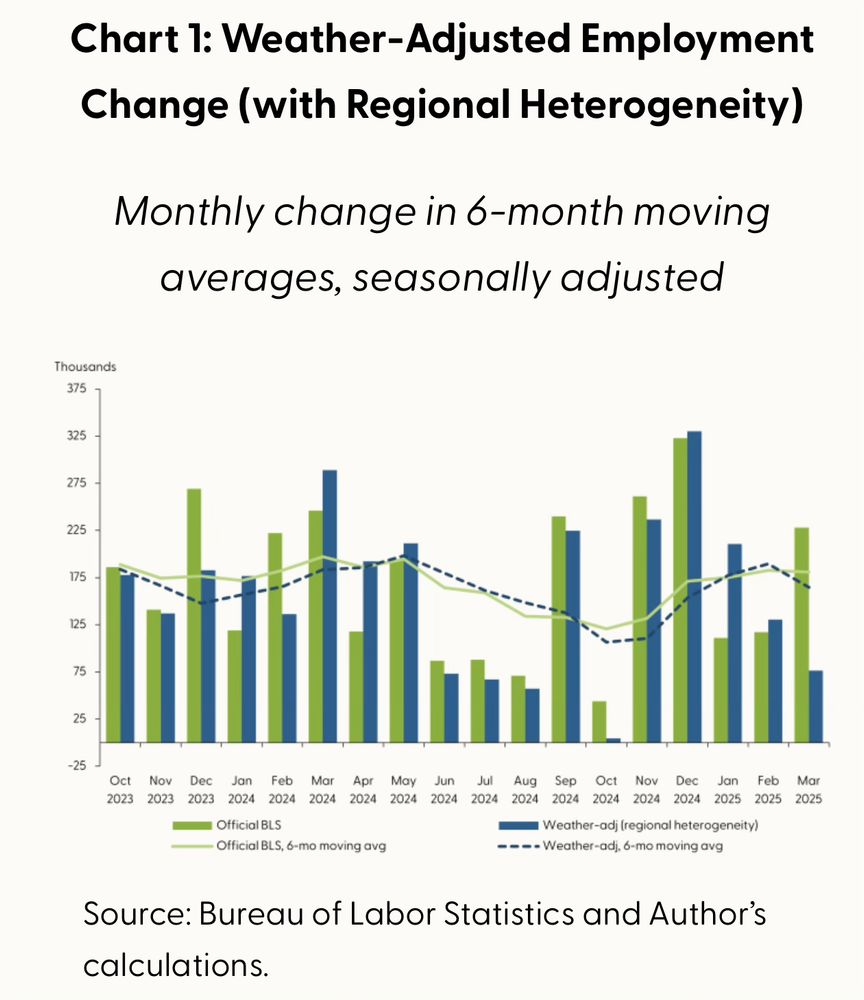

- Todays labor market report was not great after adjusting for weather

- Unseasonably warm weather boosted payroll employment by 150,000 in March www.frbsf.org/research-and...

- Unseasonably warm weather boosted payroll employment by 150,000 in March www.frbsf.org/research-and...

- Helpful table from Goldman:

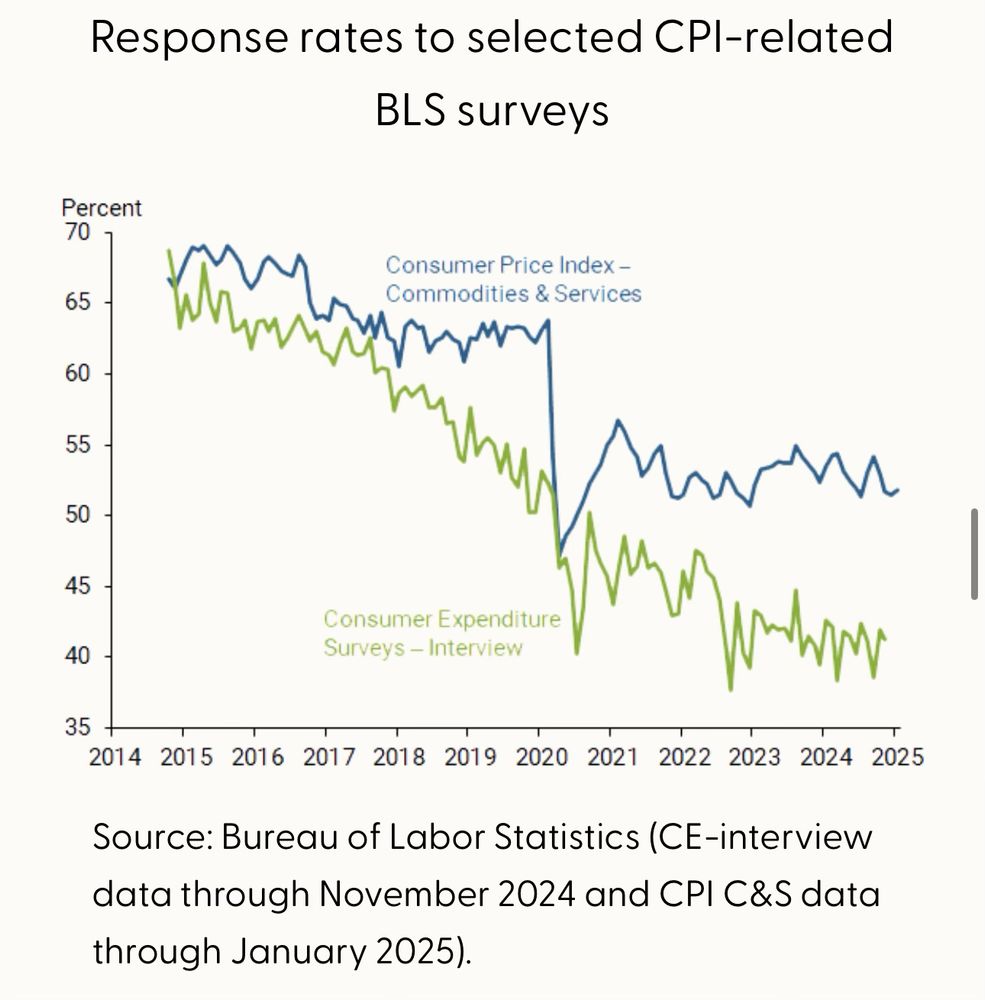

- Response rates to statistical surveys have been plummeting. www.frbsf.org/research-and...

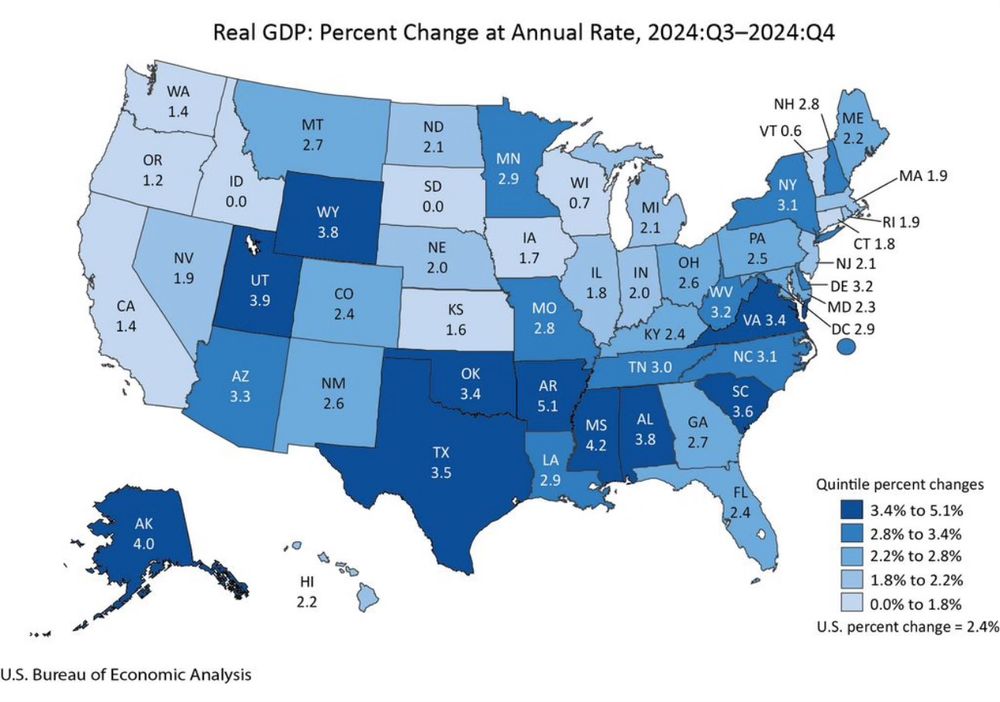

- The South had a good 2024:Q4

- A bit of a resurgence in demand-driven inflation, according to the SF Fed supply & demand driven inflation series. It looks like supply-factors are not currently a major contributer to rising inflation pressure. www.frbsf.org/research-and...

- At 5.4%, California has the second highest unemployment rate in the country (behind Nevada) www.frbsf.org/research-and...

- The SF Fed daily news sentiment index is showing a steady decline since its Nov 13 peak www.frbsf.org/research-and...

- Reposted by 𝖠𝖽𝖺𝗆 𝖲𝗁𝖺𝗉𝗂𝗋𝗈[Not loaded yet]

- Reposted by 𝖠𝖽𝖺𝗆 𝖲𝗁𝖺𝗉𝗂𝗋𝗈[Not loaded yet]

- Given all the volatility in financial markets you’d think the VIX would be higher

- Reposted by 𝖠𝖽𝖺𝗆 𝖲𝗁𝖺𝗉𝗂𝗋𝗈[Not loaded yet]

- Reposted by 𝖠𝖽𝖺𝗆 𝖲𝗁𝖺𝗉𝗂𝗋𝗈Got the ball rolling on a Fed Economists starter pack go.bsky.app/GudXeoo Fed economists, let me know if you’re on Bluesky and I’ll add youat://did:plc:dr4d5m4qia47ak3skn26ukyl/app.bsky.graph.starterpack/3l2ogmo6lry2o

- Reposted by 𝖠𝖽𝖺𝗆 𝖲𝗁𝖺𝗉𝗂𝗋𝗈[Not loaded yet]

- Reposted by 𝖠𝖽𝖺𝗆 𝖲𝗁𝖺𝗉𝗂𝗋𝗈[Not loaded yet]

- “had central banks tried to fully offset the inflationary pressures due to sustained demand, this would have resulted in a much more severe global economic contraction.” libertystreeteconomics.newyorkfed.org/2025/02/supp...