Search

- The EU plans $107B tariffs on US goods, including agriculture, industry, cars, and Boeing planes, if talks fail. Tariffs may rise. Trump’s policies harm global economies, impoverishing Americans. #TradeWar #EUTariffs #USTariffs #DonaldTrump #GlobalEconomy #PeterNavarro #EconomicPolicy #TariffImpact

- EU Prepares Boeing Tariffs as Aerospace Faces New Trade Clash wiobs.com/eu-prepares-... #Boeing #Airbus #TradeWar #AerospaceIndustry #EUTrade #USTariffs #AviationNews #GlobalTrade #AircraftManufacturing #SupplyChain

EU Prepares Boeing Tariffs as Aerospace Faces New Trade Clash - WIOBS

The EU plans Boeing tariffs in response to U.S. levies on Airbus, reigniting a $150B aerospace trade war. Will diplomacy avert...wiobs.com https://www.investing.com/news/economy-news/eu-to-set-out-next-countermeasures-against-us-tariffs-on-thursday-4028768?utm_source=dlvr.it&utm_medium=bluesky

investing.comUS tariffs, Europe slowdown reshape global solar panels trade

SINGAPORE (Reuters) -Solar panel makers in Laos and Indonesia, mostly owned by Chinese firms, boosted their share in the U.S. market after steep tariffs hit exports from other Southeast Asian countries including Cambodia and Thailand, trade data showed. The U.S. government finalised steep levies on imports of solar cells and modules from Vietnam, Malaysia, Thailand and Cambodia in April, following two rounds of tariffs in June and November last year, to prevent dumping by mostly Chinese-owned factories in these countries. However, Chinese companies have moved their production to Indonesia and Laos and boosted exports to the United States, Reuters reporting showed. The combined share for Indonesia and Laos in the U.S. solar modules market rose to 29% in the three months after the second round of U.S. duties were imposed on neighbouring producers in late November, from less than 1% in 2023, a Reuters review of U.S. trade data showed. Analysts and industry experts say the southeast Asian capacities owned by Chinese companies were almost exclusively set up to sidestep tariffs and supply the U.S. markets at premiums to global prices, exposing the limits of Washington’s trade interventions. Yana Hryshko, head of global solar supply chain research at consultancy Wood Mackenzie, said all solar manufacturing capacity in the four Southeast Asian countries hit with high tariffs would now likely "be shut down or reduced dramatically". CHANGING TRADE ROUTES Solar panel exports from Vietnam, Malaysia, Thailand and Cambodia to the U.S. fell by 33% on an annual basis in the nine months since the first round of tariffs in June. In the same period, exports from regional neighbours Indonesia and Laos grew around eight-fold, the trade data showed. Overall U.S. solar panel imports have fallen 26% since June, with the four countries’ combined share of the market plunging from 82% in the full year 2024 to 54% in the three months following the second round of tariffs in late November. U.S. imports of solar cells, which can be assembled in the United States to create panels, have tripled since the first round of tariffs despite higher costs of imports from the targeted countries. However, Indonesia and Laos still ate into the market as their exports surged about 17-fold. Solar cells accounted for roughly 28% of all U.S. solar imports since the first round of tariffs, compared with 6.5% in 2023, the data showed. Chinese manufacturers are already revising export strategies due to concerns about tariffs on Indonesia and Laos, said Fei Chen, solar research analyst at consultancy Rystad Energy. "Several solar manufacturers plan to set up production bases in non-Southeast Asia regions such as Turkiye, Oman, Saudi Arabia, UAE, Ethiopia, to supply the U.S. market," she said. Factories in China, mostly shut out of the U.S. market for over a decade by high import duties, have been boosting solar panel sales to Asia and Africa, data from energy think-tank Ember showed. Total Chinese exports have remained steady despite lower demand due to high stockpiles in Europe - its biggest market.investing.comhttps://www.investing.com/news/economy-news/escalated-uschina-tariffs-a-loselose-scenario-prior-to-trade-talks--citi-4027484?utm_source=dlvr.it&utm_medium=bluesky

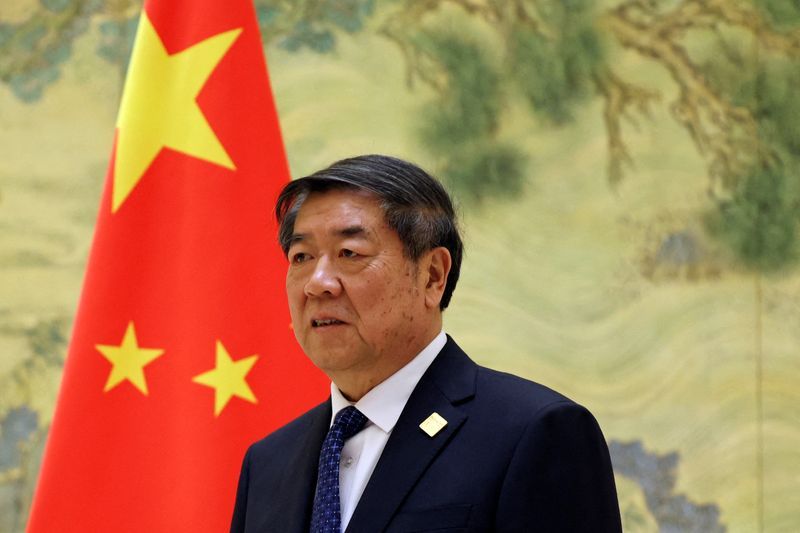

investing.comhttps://www.investing.com/news/economy-news/chinas-trade-tsar-in-the-limelight-for-us-tariff-talks-4026881?utm_source=dlvr.it&utm_medium=bluesky

investing.comhttps://www.investing.com/news/economy-news/chinas-capital-markets-under-pressure-from-us-tariffs-regulator-says-4026861?utm_source=dlvr.it&utm_medium=bluesky

investing.comAlgoma Steel’s credit rating drops at S&P due to U.S. tariffs impact

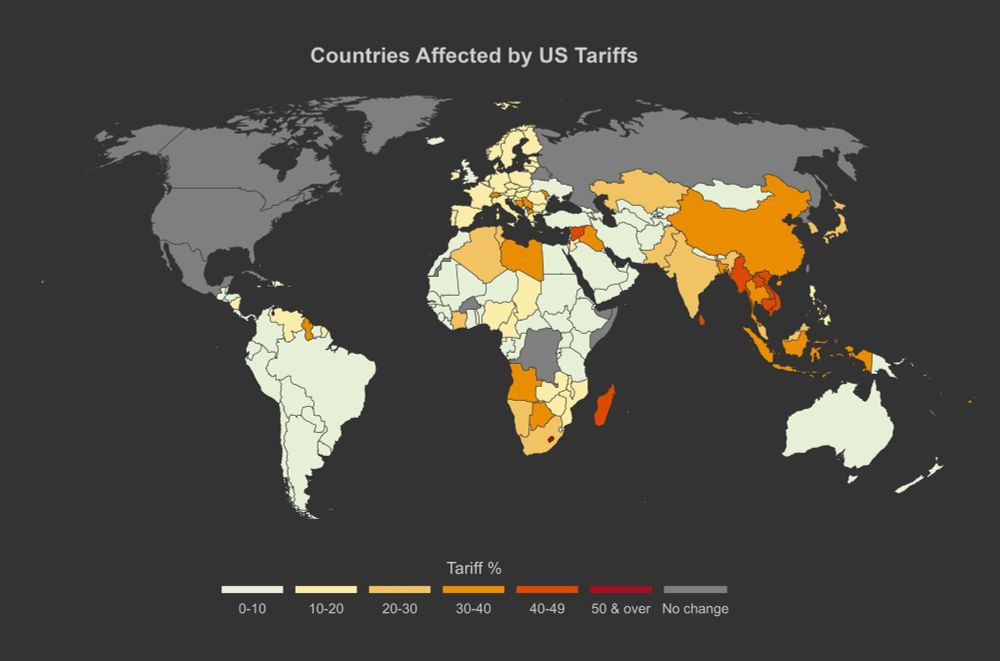

Investing.com -- S&P Global Ratings has downgraded the credit rating of Canada-based steel producer Algoma Steel Inc. from ’B-’ to ’CCC+’ due to the significant impact of the 25% U.S. tariffs on steel imports from Canada. The credit rating agency anticipates these tariffs to persist over the next few years, leading to sustained cash flow deficits for Algoma Steel and likely resulting in an unsustainable capital structure. The lowered rating also applies to the company’s second-lien secured notes due in 2029, which have been downgraded from ’B’ to ’B-’. The recovery rating stands at ’2’, indicating a substantial recovery expectation, between 70% to 90%, in case of a payment default. The future rating outlook is developing, implying potential for a higher or lower rating over the next 12 months. If cash flow deficits significantly erode Algoma’s liquidity, increasing the likelihood of default, the rating could be further lowered. On the other hand, if cash flow prospects improve and Algoma’s capital structure is no longer seen as unsustainable, the rating could be raised. This scenario would likely involve reduced U.S. tariffs on steel imports from Canada and increased production at Algoma’s new electric arc furnace (EAF) facility. Algoma Steel, which gets about 60% of its revenue from sales to customers in the U.S., has been subject to a 25% tariff on all its steel shipments to the U.S. since March 12, 2025. The company has struggled to offset these tariffs with higher prices. For the first quarter of 2025, the tariffs cost Algoma approximately C$11 million for about two weeks of shipments, leading to negative EBITDA. The tariff costs are estimated to amount to C$65 million-C$70 million per quarter based on projected sales volumes over the next 12 months. The Canadian steel market is also dealing with an excess supply of sheet, which makes up about 85% of Algoma’s shipment volumes. Foreign markets previously selling to the U.S. are now redirecting some volumes to Canada, limiting Algoma’s ability to realize better prices. Algoma’s liquidity sources, as of March 31, 2025, included about C$227 million of cash and C$361 million availability under its asset-based lending (ABL) facility. These funds are expected to support the completion and ramp-up of its EAF project through the end of this year. However, negative EBITDA generation is expected under the base-case scenario that assumes tariffs remain in effect, which could lead to significant deterioration of the company’s liquidity through 2026. Algoma’s transition to EAF steelmaking is expected to increase capacity and potentially improve its cost profile over the longer term. The company plans to start steelmaking from its first EAF facility later this quarter, with a second facility set to be completed before the end of the year. Algoma expects to transition away from its current blast furnace operations by the end of 2026, a move that could increase its capacity while reducing its fixed costs, lowering its sustaining capital expenditure (capex), and cutting its carbon emissions. The company has already spent about 90% of its estimated project capital costs of C$900 million-C$925 million, with most of the remaining spending under fixed-price contracts, reducing the risk of significant cost escalations. Despite this, the company remains exposed to unanticipated ramp-up issues, or an inability to achieve management’s targeted per-unit cost. The future rating outlook considers the possibility of the current 25% tariff on U.S. steel imports from Canada remaining in place, which could lead to further deterioration in Algoma’s credit profile. However, the rating could be raised if cash flow prospects improve due to reduced tariffs and increased production at its new EAF facility. This article was generated with the support of AI and reviewed by an editor. For more information see our T&C.investing.com- Who’s feeling the heat from US tariffs? My new map breaks it down. Some countries are at just 10%, and others? No change at all. Where does your country stand? #USTariffs #tariffs

- In today’s special #MovingMarkets podcast episode, Christian Gattiker, Head of Research, shares his insights on what investors should do, as US #equity markets suffer their worst drop since Covid. Listen now: ➡️ Apple: buff.ly/unmZRRq ➡️ Spotify: buff.ly/zJmBLC9 #USTariffs #MarketInsights