Tax Notes

Your #1 source for everything tax.

News, commentary, analysis | taxnotes.com

Nonpartisan nonprofit.

- Two Senate Democratic taxwriters are scrutinizing IRS Commissioner nominee Billy Long’s ties to a company that has been promoting tax credits that the IRS says don’t exist. Read more: www.taxnotes.com/tax-notes-to...

- A district court judge refused to enjoin the IRS from disclosing tax information to the Department of Homeland Security to help with immigration enforcement under a new agreement between the agencies. Read more: www.taxnotes.com/tax-notes-to...

- Treasury would be required to end Direct File and explore the creation of a new public-private filing program under the tax package proposed by House Republicans. Read more: www.taxnotes.com/featured-new...

- A former Treasury official expressed hope that the Trump administration’s tariffs, though ill-advised, could spur policymakers to give more credence to the merits of a consumption-based tax in the United States. Read more: www.taxnotes.com/tax-notes-to...

- The IRS will have to revamp its audit and litigation strategy for partnership related-party basis-shifting transactions following the Trump administration’s repeal of a guidance package, according to a former Treasury official. Read more: www.taxnotes.com/tax-notes-to...

- A group that has called the IRS “a deep-state, domestic intelligence operation” alleged the agency hasn’t handed over all leadership communications about pardons of the January 6, 2021, insurrection participants, violating the Freedom of Information Act.

- "The more limited availability of human resources and the continued questions that folks are going to have is going to just increase the need for chatbots to fill some of the gap that we're likely to see in available information for the public," Professor Leigh Osofsky explains.

- "Lawmakers acknowledged that many government agencies had a legitimate need for access to tax return information," @joethorndike.bsky.social writes. "But they also understood that any compromise of privacy protections posed a serious threat to the tax system."

- A proposed 20 percent IRS funding cut in the administration’s fiscal 2026 budget would reduce the tax collector’s funding to its lowest level since 2002, despite accumulated inflation amounting to 70 percent in the interim. Read more: www.taxnotes.com/tax-notes-to...

- Do low tariffs really benefit everybody? Tax historian Joseph Thorndike explains why acknowledging the "losers" in free trade has become central to tariff politics today.

- Commerce Secretary Howard Lutnick said the Trump administration aims to replace the IRS with an “External Revenue Service” to administer tariffs, but tax policy watchers doubt the new agency would collect enough revenue to adequately fund the government. Read more: www.taxnotes.com/featured-new...

- The Senate Finance Committee advanced President Trump’s pick for Treasury assistant secretary for tax policy despite concerns from Democrats that he has a conflict of interest in the role from his work as a former tax lobbyist. Read more: www.taxnotes.com/tax-notes-to...

- California lawmakers are urging the Franchise Tax Board to proactively prepare for how the Trump administration's cuts to the IRS could affect state tax collections. Read more: www.taxnotes.com/tax-notes-to...

- IRS employees in the division responsible for ensuring that large businesses, complex partnerships, and wealthy individuals pay their taxes say pressure from the Trump administration is causing people to leave. More from @laurenloricchio.bsky.social: www.taxnotes.com/tax-notes-to...

- NEW: This week on the podcast, Tax Notes Capitol Hill reporters @cadystanton.bsky.social and Katie Lobosco outline Congress’s progress on drafting the tax-focused reconciliation bill and the obstacles still remaining. Listen here. 👇

- JUST IN: The EU Council’s Polish presidency reportedly has proposed three options to assuage U.S. concerns about the OECD's pillar 2 minimum tax rules. Read more: www.taxnotes.com/tax-notes-to...

- "Tariffs on small packages will certainly make production more difficult for China-based e-commerce retailers, but it may not be an immediate death knell," Nana Ama Sarfo writes.

- Treasury said it’s still weighing the future of Direct File and called it a “failed program” that serves a small percentage of taxpayers. Read more: www.taxnotes.com/featured-new...

- Congressional Democrats and nonprofit advocates are opposing what they deem an illegal weaponization of the IRS amid reports that the Trump administration has asked the agency to revoke Harvard University’s tax-exempt status.

- President Trump, already causing alarm in the higher education and nonprofit sectors with his questioning of Harvard University’s tax-exempt status, is directing similar attacks against @crew.bsky.social, a government ethics watchdog that has challenged him in court. www.taxnotes.com/tax-notes-to...

- Members of the OECD inclusive framework on base erosion and profit shifting want to work with the United States to find a way forward on global minimum tax rules, the OECD’s tax head said. Read more: www.taxnotes.com/tax-notes-to...

- The IRS is on track to lose nearly a third of its workforce this year after about 20,000 employees accepted the second deferred resignation offer, according to a person familiar with the matter. Read more: www.taxnotes.com/tax-notes-to...

- A Kansas bill creating an income tax exemption for parents of unborn children has become law after the Legislature overrode Democratic Gov. Laura Kelly's veto. Read more: www.taxnotes.com/tax-notes-to...

- "Policymakers should accept that consumption taxes are inevitably regressive," Robert Goulder writes. "Our fiscal systems can (and should) compensate for the regressivity in other ways, through other taxes."

- JUST IN: The IRS has removed nine pieces of subregulatory guidance in accordance with an executive order by President Trump to improve government efficiency by reducing regulations. Read more: www.taxnotes.com/tax-notes-to...

- The departure of acting IRS Commissioner Melanie Krause will add to unprecedented levels of change in IRS leadership, according to observers. Read more: www.taxnotes.com/tax-notes-to...

- Billy Long, President Trump’s pick to head the IRS, earned nearly $250,000 in income last year from businesses involved in the promotion of the employee retention credit. Read more: www.taxnotes.com/tax-notes-to...

- JUST IN: The IRS and Department of Homeland Security signed an agreement to disclose immigrants’ tax data, according to court filings. Read more: www.taxnotes.com/tax-notes-to...

- Americans will receive two very different types of estimates when the tax-heavy reconciliation bill is written and scored — one that says extending the 2017 tax bill will cost around $4.6 trillion, the other that it will cost nothing. Read more: www.taxnotes.com/tax-notes-to...

- The IRS has initiated the reduction in force process, with layoffs expected in the Office of Civil Rights and Compliance, according to an email obtained by Tax Notes. Read more: www.taxnotes.com/tax-notes-to...

- NEW: Professor @akahrl.bsky.social, author of "The Black Tax: 150 Years of Theft, Exploitation, and Dispossession in America," discusses his argument that local property taxes have contributed to the disenfranchisement of Black homeowners. 🎧 Listen here: www.buzzsprout.com/124942/episo...

- A budget resolution with sparse details on spending cuts and a novel method of scoring tax extensions faces a week or so of debate and votes to get through Congress so that the detailed process of writing a tax-heavy reconciliation package can begin. Read more: www.taxnotes.com/tax-notes-to...

- The chair of the House Ways and Means Oversight Subcommittee, which has jurisdiction over the IRS, said the agency is no longer returning his calls. Read more: www.taxnotes.com/featured-new...

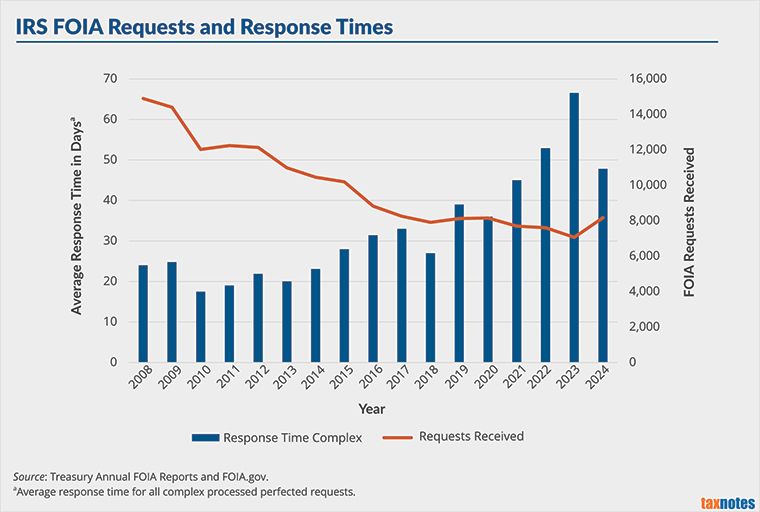

- The number of FOIA requests received by the IRS has been declining, but response times haven’t improved, frustrating tax attorneys who say they may not be able to use records by the time they’re issued. Read more: www.taxnotes.com/tax-notes-to...

- "As history shows, turning the outdated-technology ship around is especially hard when confronted with the realities of government," Marie Sapirie writes.

- Former Missouri Rep. Billy Long, picked by President Trump to lead the IRS, has begun working as an adviser at the Office of Personnel Management while awaiting Senate confirmation. Read more: www.taxnotes.com/tax-notes-to...

- "One source who works in tax resolution told me that he was essentially ghosted by the collections officer that he'd been working with because they were fired and he had to scramble to find out who to call." ☝️ Tax Notes IRS reporter Benjamin Valdez on the agency's recent staffing developments.

- President Trump’s appointed border czar, Tom Homan, said he hopes the IRS will finalize a deal with the Department of Homeland Security to share information on suspected undocumented immigrants. Read more: www.taxnotes.com/featured-new...

- A district court judge said that DOGE didn’t provide a proper explanation for why it needs access to millions of records detailing the personal information of American taxpayers to perform its duties. Read more: www.taxnotes.com/tax-notes-to...

- Perspective: @joethorndike.bsky.social reviews "The Black Tax: 150 Years of Theft, Exploitation, and Dispossession in America" by @akahrl.bsky.social, which explores the ways in which local property taxes have been used as an instrument of systemic racial inequality.

- Opinion: "If enacted, the FPFA will bolster the global competitiveness of U.S. manufacturers, forge relationships with our internal trading allies, and bring new revenue to the U.S. treasury." 👉 Sen. Bill Cassidy, R-La., and Darren Rutledge's new op-ed in Tax Notes: www.taxnotes.com/featured-ana...

- Perspective: Nana Ama Sarfo reviews the first year of the Regional Platform for Tax Cooperation in Latin America and the Caribbean.

- #IRS Rollout of In-Person Work Faces Obstacles: Implementation of the IRS’s return-to-office mandate has been rocky, with inadequate space for some employees and new requirements that requests for disability accommodations get additional levels of approval. Read more: taxnotes.co/4iGXSZL

- Changes at the Justice Department Tax Division — including the loss of entry-level attorneys and senior personnel — could affect refund litigation and the tax system as a whole, tax attorneys told Tax Notes. Read more: www.taxnotes.com/tax-notes-to...

- The IRS has taken steps to reinstate thousands of probationary employees after a Maryland federal court held that the Trump administration’s mass firings of them were unlawful. Read more: www.taxnotes.com/tax-notes-to...

- An official with the Department of Government Efficiency (DOGE) sent personally identifiable data insecurely, according to the chief security officer for Treasury’s Bureau of the Fiscal Service. Read more: www.taxnotes.com/tax-notes-to...

- Trump administration efforts to use the IRS in its crackdown on undocumented immigrants are giving rise to worry that the government could improperly use tax data to help with deportations. Read the full story: www.taxnotes.com/featured-new...

- President Trump wants to eliminate taxes for those earning less than $150,000, according to Commerce Secretary Howard Lutnick. Read more: www.taxnotes.com/tax-notes-to...